What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Last week, Russian President Vladimir Putin launched an invasion of Ukraine by land, sea and air – the biggest attack by one state against another in Europe since World War Two.

As developments continue to unfold, we examine what history tells us about geopolitical events and what the invasion of Ukraine means for financial markets in this week’s Market Pulse.

Impact of past invasions

- This is the second Ukrainian crisis in the last decade, but this has been elevated with a declaration of war and a full-scale invasion. The last crisis led to the occupation and annexation of Crimea but low scale military engagement.

- Since the end of the Cold War there have been three ‘invasion’ events’ – Iraq’s invasion of Kuwait, the first Gulf War and the second Gulf War – but they had different impacts on financial markets.

- During the first and second Gulf War, the Euro Stoxx reached its lows just as the invasions began; it was 14% and 15% higher respectively three months later. This was not the case with the Iraq invasion of Kuwait. After three months, the Euro Stoxx was 20% lower.

- What was the difference? As Iraq invaded Kuwait the US was slipping into recession pulling the world with it. In the other two instances, the global economy was in recovery mode and pulled markets higher. The important driver was not the ‘invasion’ event but rather the progress in the global economy.

Market reaction

- Equity markets have recovered modestly after the initial sharp drop. There is some relief that sanctions that have been imposed do not include a ban on energy products. This increases the chances of containing the economic impact of the war. For us, that is the important factor, as the past has shown, and keeps us overweight equities.

- Fixed income markets did rally initially with a ‘flight to safety’ but that is dissipating now, and they were little changed over the week. They still have to contend with rising interest rates and that keeps us underweight and short duration.

- In equity markets, there was a shift towards the dependable growth sectors; Healthcare and IT were the best performing sectors last week. These have been out of favour over the last couple of months, but valuations have corrected, and investors have just been reminded about the value of dependable growth. This together with the reopening theme remain our favourite plays as earnings growth begins to decelerate overall.

Chart of the week: Euro area economic sentiment is strong

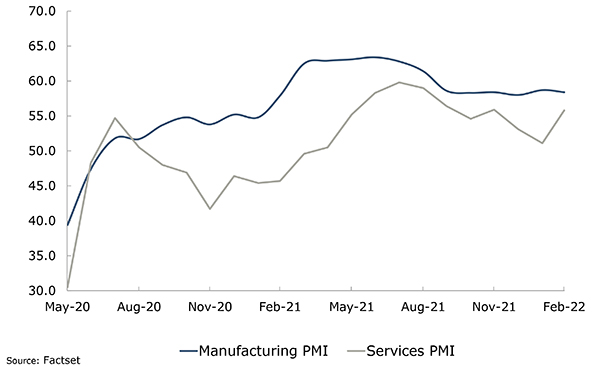

While we look at events unfold in the Ukraine and think about the potential implications, we did get reassuring data on the euro area economy. We know that there was a decline in activity as the Omicron variant led to a drop in mobility, but we believed this would be temporary and short lived. The sentiment indicators for the euro area in January released last week support that view with a strong rebound in the Services Purchasing Managers’ Index (PMI) which cover the industries impacted by the reduction in mobility. It is important to see the euro area economy in strong condition as it faces the fallout from the invasion of Ukraine.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |