What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

- Financial markets were relatively calm last week and ended about flat in local currency items. Inflation statistics were lower, or at least no worse than expected. Most analysts believe the data supports a ‘pause’ from the US Federal Reserve.

- Fixed income markets were also relatively stable last week. US bond yields were little changed on the back of the inflation data, up and down a few basis points. Euro area bond yields were similarly stable.

- Below the index level, equity sector leadership has remained pretty much unchanged from recent trends. Consumer Discretionary and Communications Services are leading, while commodity sectors Financials and Health Care are lagging.

- Over 90% of the S&P 500 companies and 70% of the STOXX Europe 600 companies have reported Q1 earnings. In the US, earnings have come in ~7% ahead of expectations, while in Europe, the outperformance is ~11%. In both cases estimates were reduced heading into results, presenting a low bar. The major US consumer exposed stocks are still due to report and will be closely watched to gauge sentiment.

- US debt ceiling negotiations seem likely to run down to the wire, or beyond. This is likely to mean more market volatility in the weeks to come.

Macro views

- The main economic releases last week were about US inflation. Inflation remains high on a year-over-year basis, but the trend is lower, with significant slowdowns evident in some key categories. In the US, the trends are seen to support a pause by the Fed, i.e., it will not change policy rates at its next meeting. Market pricing suggests rates will be cut far sooner than central banks expect. Central banks are focused on getting inflation down. Only time will tell if they are fighting the last war.

- US CPI came in at 0.4% m/m, in line with expectations and flat vs the prior month. The year-on-year increase declined to 4.9% from 5.0%. Core CPI came in ~10 bps high at 0.4% m/m. The Fed has flagged Core Services ex Shelter inflation as something it is watching closely; this excludes the large but lagging rent/owners’ equivalent rent impact on the inflation output. The run rate of this measure at ~2.25% has dropped sharply, which combined with weaker goods inflation (excluding noisy used car prices) suggests monetary policy is having the desired impact.

- The Bank of England raised rates again last week to 4.5% and expects to continue raising them to try to bring inflation down.

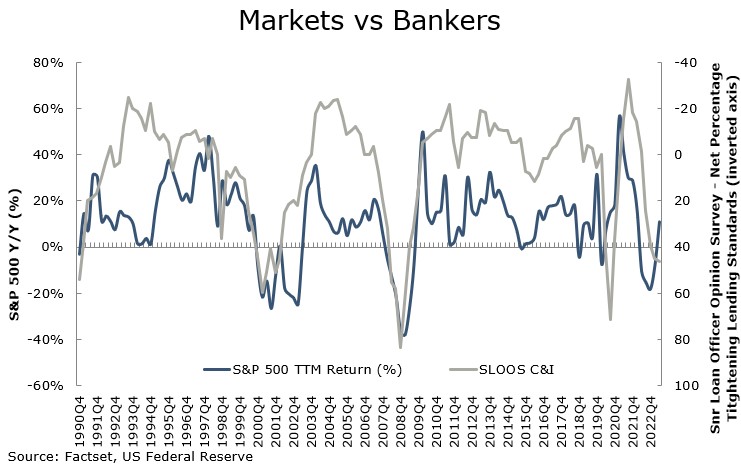

Chart of the week: Reduced Supply of Credit?

The recent US banking crisis has raised concerns that a credit contraction, i.e., reduced supply of credit, will reduce economic growth as businesses will not want or be able to borrow to invest in growth. Undoubtedly, the recent US bank deposit outflows into higher yielding money market funds etc reduce some banks’ capacity to lend. Given US bank industry loans/deposit ratios were near historic lows that does not seem overly concerning (deposits surged during the pandemic and are still normalising, albeit at different speeds for different banks). Nonetheless, banks are likely to be more selective when approving future loans. This shows up in the US Federal Reserve’s Senior Loan Officers Opinion Survey, i.e., ‘SLOOS’, where bankers indicate whether they will tighten or loosen lending standards. Per the most recent survey a high net proportion of bankers expect to tighten lending standards (tightening – loosening respondents). Should we be worried? The chart above shows that bankers’ opinions tend to be coincident but negatively correlated with equity markets’ trailing returns, i.e., the net percentage tightening tends to peak near equity market troughs. It could get worse, but bankers may be saying what equity markets have already discounted.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |