What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

- After a brutal September for all asset markets, some calmness returned to markets last week. Equities posted a return of just under 2.0%. Bond markets were little changed from the levels they reached the previous week but have recovered from the lows during the mini gilt crisis. The theme of ‘bad news is good news’ was a feature last week. A poor Manufacturing ISM survey in the US sparked the recovery in equity markets. This halted as we got a better non-Manufacturing ISM and a robust non-Farm Payrolls.

- The dull response from the bond market is disappointing but it was as much focussed on speeches from FOMC (the interest rate setting body in the US) members as trying to interpret the data. All eyes will be on the US CPI release this week. This was the data point that sent us into a tailspin in September. So, perhaps bond investors do not want to do too much before they see what that figure is like.

- We have moved into ‘bad news is good news’ mode. Both bonds and equities are looking for hints that the US economy is cooling which can allow the Federal Reserve to ease its hardline. Forecasts for US economic growth are still being cut, so we should be seeing some softness in the data releases which should boost financial markets. We would expect this to happen and having a defensive bias while we wait for this to happen is the best approach.

Macro views

- The minutes from the September European Central Bank (ECB) policy meeting, which were released last week, were more dovish than expected. The policy rate was increased by 75bps, and it said that there will be further increases to come. However, there was more discussion on data dependency of future moves than was expected and more debate about the growth sensitivity of future actions. Some members felt a 75bp hike was too much as wage increases remain moderate. More increases are on the way but bringing sensitivity of economic growth into the discussion could lead to a more cautious policy.

- The data from the US reveals a reasonable robust economy. The non-Manufacturing ISM was little changed in September, staying at a very healthy 56.7. The Manufacturing survey on the other hand dropped below 50, pulled down by the New Orders sub-index. One good thing from both surveys was further drops in the pricing subindex – and both surveys indicate that inflation pressures are declining. The non-Farm Payrolls showed a healthy growth in employment: 263,000 jobs were created in September and there was a drop in the unemployment rate towards record lows.

- The retail sales report was released in the euro area. After declining for the previous two months, core retail sales increased marginally in August. One cannot read too much into one data point but there was some relief that it has not turned into a straight line down. Consumer confidence remains very low in the euro area and will be coming into high energy bills. The expectation is that retail sales growth will come under further pressure but a pause in the journey was welcome this month.

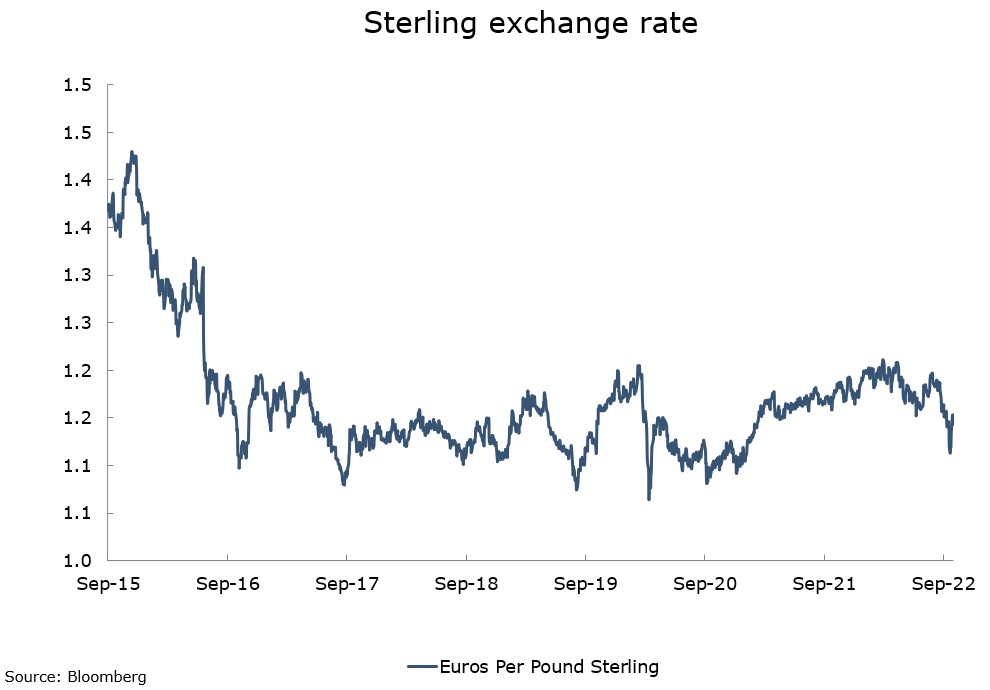

Chart of the week: back to the bottom of the band

The recent turmoil in the UK has just brought the sterling-euro exchange rate back towards the bottom of the range it has traded in since the Brexit vote. The biggest negative for the currency is the loss of credibility of UK institutions. That takes time to reverse. There are positives, however. It looks like we will have higher interest rates in the UK than we thought a month ago, which will support the currency. On the other side, the euro area is also facing challenges we did not expect at the start of the year. So, sterling is likely to stay within this range but at the lower end of it.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |