What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

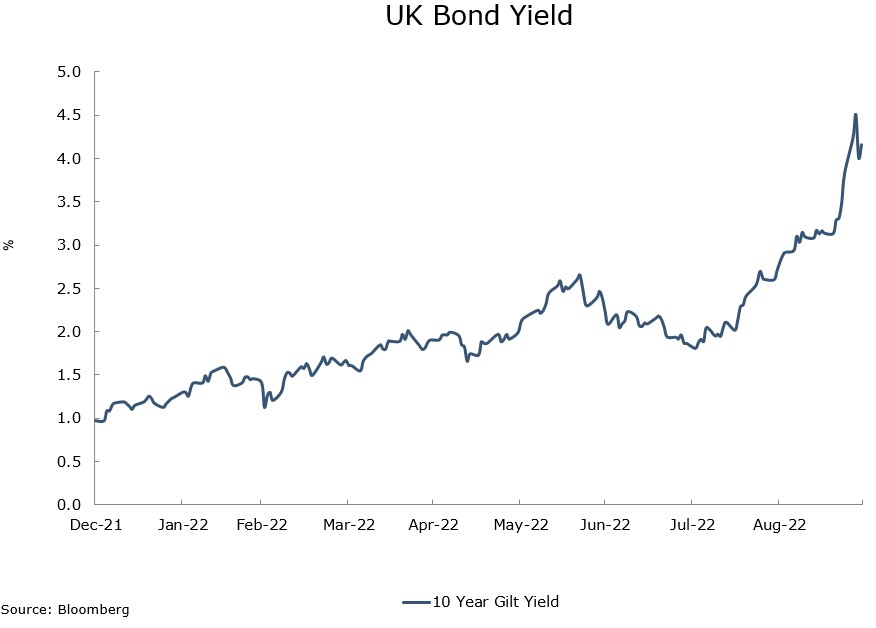

- It was a tough week in financial markets. The UK government bond market slipped towards freefall after the UK government’s mini budget on 23 September and it took intervention from the Bank of England to restore some semblance of stability. The lesson from that is that central banks may be willing to see yields rise but only in an orderly manner. Any hint of instability and they are likely to intervene.

- Bond markets were down and volatile across the globe. Even the US Treasury was seeing significant falls on a daily basis, although it ended the week virtually unchanged. Reasonable data from the US, in particular from the labour market, keeps the bond market in a jittery mood. This has transferred over to equity markets, world equities were down over 3% in euro terms, not even better growth indicators from the US could help here.

- The inflation journey is the key influence in the short term. As was said last week, weaker growth data in the US would probably go down well in both bond and equity markets. We do expect some slowing in the US as the tightening in financial conditions that has already occurred begins to impact; the continuing impact of base effects and weaker commodity prices will begin to spread through the pricing system. We do believe that the inflation outlook will improve, and this should give some relief to asset prices. Meantime, the indications are that we will avoid a global recession and that should give an extra fillip to equity markets.

Macro views

- Fiscal policy took centre stage over the last week with the UK the main focus of attention. So far, we have a mini budget with no independent costing of its measures. Next up, the Bank of England will outline the implications of the changes in fiscal policy on its planned monetary policy changes at its policy meeting on 6 November. Subsequently, the government’s medium term fiscal policy plans and an independent costing from the Office of Budget Responsibility will be released on 23 November. Sterling assets have declined a lot in euro terms recently, but there are further chapters in this story to see before we get a good picture of the outlook; already we are seeing some backtracking by the government. The Bank of England’s reaction last week shows the danger of being too pre-emptive.

- Italy had a change of government, and the market reaction was extremely subdued. The bond spread has headed back towards the high for the year but given the volatility in financial markets over the last couple of weeks one would have expected that anyway. The governing parties’ manifesto was very light on specifics. It talked of higher spending, but that fiscal policy would respect EU rules, which has calmed investors. Let’s hope markets are not being complacent.

- Data was not helpful during the week. The euro area is slowing rapidly (falling consumer confidence and a weak IFO survey in Germany), while headline inflation remains elevated (up again month-on-month), keeping the pressure on the European Central Bank. Meanwhile, the US economy remains robust (jobless claims were down, durable goods orders and consumer confidence were up) leaving the Federal Reserve to maintain its tightening course.

Chart of the week: So, this is what disorderly looks like

The bond market’s reaction to the UK government’s mini budget was particularly savage. The yield had been rising prior to the announcement but it accelerated appreciably after it. Within five trading days, it rose a staggering 1.2%. The move started to cause dislocations in the real economy. As a result, the Bank of England took off its ‘monetary policy hat’ and put on its ‘financial stability hat’ and started buying UK government debt. It was meant to start selling down its gilt holdings next week. We are still at early stages of this evolving story, so a wait-and-see approach is probably best at the moment.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |