What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

The failure of Silicon Valley Bank (SVB) was the focus of markets last week. It led to a dive in equities and bounce in the fixed income markets. But the impact has been lessened as the authorities in the US moved last night to guarantee all the deposits of SVB and Signature Bank, which has also failed. They have established a new liquidity facility for banks and the policy moves should stop the contagion risk to the financial sector and the real economy. For example, SVB’s corporate customers will now be able to pay staff. Below are some implications that we expect will unfold over time.

SVB was a relatively small bank, with a narrow franchise. Less than 5% of deposits were FDIC insured compared to ~2/3rds for the industry. It availed of several small bank exemptions for regulatory capital and liquidity requirements that apply to the larger banks that comprise most of the sector. It seems likely to us that the regulatory environment will tighten, particularly for smaller banks. Investors are now more cognisant of the risks to banks of higher interest rates. Counterparty credit risk may be more heavily scrutinised. Higher liquidity requirements will likely mean higher deposit and wholesale funding costs for banks. Longer term there could be further bank industry disintermediation, which carries other risks.

For investment strategy, we would regard this as evidence that we are late cycle and that a cautious view of equities is correct. Interest rates have been increased a lot over the last 12 months and while this has been reflected in valuation levels of all assets, the impact on the growth potential of economies may not been fully reflected. It was reassuring to see bond markets give some protection during this risk event.

Macro views

Last week in the US, surveys from the Institute for Supply Management (ISM) were released and told the same narrative that we have previously seen from other data releases. The US economy may have been softening in the latter stages of 2022, but it has started 2023 on an uptrend. The Services survey was well into expansion territory and while Manufacturing is still below 50, it is up month-on-month and if that trend is continued then we are past the worst for the manufacturing economy. That is good news for the outlook on economic growth.

The element from the Manufacturing survey that grabbed attention and did not please, was the spike up in the Prices Paid Index. That it increased is not the major issue, it cannot keep going down for ever, but that it jumped above 50, disturbed people. Prices being paid are rising again on a month-on-month basis. This was not the only piece of news we got showing inflationary pressures are still there. The CPI index for the euro area last week (see chart of the week below) showed core inflation going to a new high.

In China we got evidence that the reopening is in full swing. The Purchasing Managers Index (PMI) for the country jumped significantly last month and there were thoughts that the move was so big there would be a bit of a cooling in the February releases. However, that was not the case. Both the Manufacturing and the Services PMI’s went further above 50. Added to this was the first monthly increase in new home sales in China in almost 2 years, which added to the optimism around outlook for the Chinese economy.

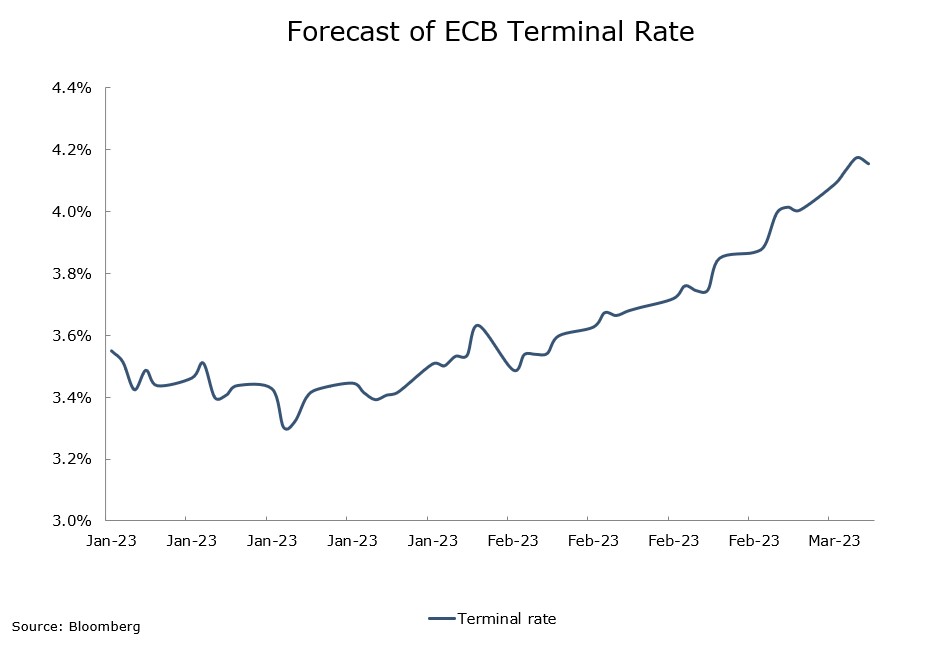

Chart of the week: Another sea change

The last month has seen another sea change in interest rate expectation in the euro area. In January, there was hope that monetary policy may not turn out as stringent as we thought in December. But as you can see in the chart above that has changed over the last three weeks with the last inflation report from the euro area being a big contributor to it. Since the middle of January, the expected peak in euro area interest rates has moved up a full 1% to over 4%. We were always somewhat uncertain where interest rates would peak, so while we were increasing our fixed income exposure to build in some durable returns, we did keep it short dated.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |