What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

A down week for both bonds and equities. Movements in interest rate expectations were again the main focus. The stronger economic growth data across the globe is leading to upward revisions for growth in 2023. But we are also seeing inflation forecasts beginning to creep up. Inflation is expected to decline but the pace of that decline is being reduced. This will keep central banks on guard.

Rising inflation forecasts are not a positive for the fixed income markets but the threat looks manageable to us. We have a running yield to cushion losses. Keeping exposure short-dated means there is continual reinvesting at the prevailing yield. Central banks are committed to bringing inflation down towards target levels which may get fixed income markets to look through some noisy inflation figures. Fixed Income markets will not mind if central banks overdo the tightening.

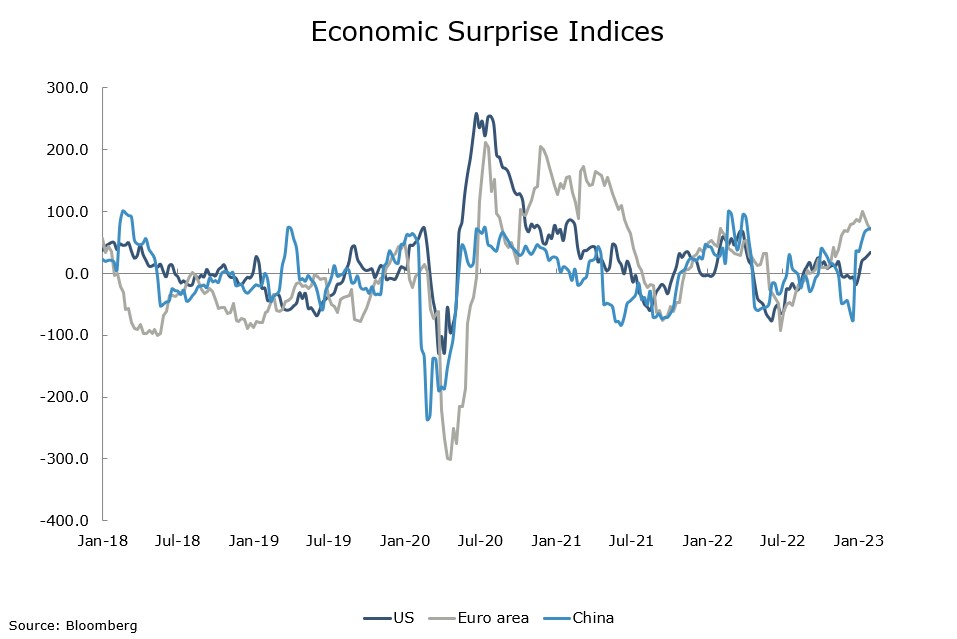

Since the beginning of the year there has been a steady flow of stronger growth data across all the major economies (see chart of the week). As a result, we should be more constructive on the outlook for equities, but this is not the case. If recession is avoided then we are still in the late stages of an economic cycle and returns from equities, (usually positive), are at the moment relatively modest because earnings growth decelerates. At the end of a cycle, cost pressures are always mounting, and margins peak out. Whether we hit recession or not, this dynamic is likely to play out over the next 12 months.

Macro views

Inflation data released last week was not encouraging. In the US the PCE (Personal Consumer Expenditures) was released. The core measure is one which the Federal Reserve looks at closely. It was revised up for January and showed an increase in the year-on-year rate which disappointed people. The final reading for January’s inflation in the euro area was a little bit higher (the year-on-year rate was 0.1% higher than the initial reading). All of this led to increases in expected interest rates in the US and euro area.

The minutes of the last FOMC meeting (interest rate setting committee of the Federal Reserve) were released last week and they indicated a still cautious central bank. The committee sees continued upside risks to inflation especially with a still tight labour market. Members felt it would “take some time” to gather “substantially more evidence” that inflation was on a “sustained” path back to target. There was no discussion of what conditions could warrant a pause in the tightening process. This suggests rates will be higher for longer. On the bright side, almost all members favoured changes to 25 basis points moves in the policy rate going forward.

The major business surveys from the euro area released last week showed a strong rebound in February with the service side of the economy leading. The Composite PMI (Purchasing Managers Index) jumped from 50.3, in January, to 52.3 well into expansion territory. This was all driven by a rebound in the services sector with its PMI jumping from 50.8 to 53. Manufacturing is still struggling, albeit with a modest improvement up 0.3 to 48.8 but still in contraction territory. If the ECB is data watching, then this release will encourage them to keep on the tightening tack.

Chart of the week: A good start to the year

The big surprise so far this year has been performance of the major economies. The Economic Surprise Indices give a measurement of how economic data compares against forecasts. When it is above zero then the data is stronger than forecasts and economies are performing better than expected. As you can see all the major regions have moved above the zero. As a result, the probability of imminent recession has fallen but the threat of one at some stage this year has not gone away. Meanwhile central banks are likely to err on the side of caution and keep policy tight.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |