What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

- This month is turning out to be a tough one for the fixed income markets with 10-year yields in the euro area and the US almost back to where they were at the start of the year. In January, it was thought that the point where the Federal Reserve would indicate no more interest rate hikes (the ‘Fed pivot’) was fast approaching. However, data for January from the US economy has shown surprising strength (non-Farm Payrolls, Retail Sales, ISM non-Manufacturing etc.). In the meantime, inflation data has been either in-line or worse than expected. The ‘pivot’ has been pushed out.

- Interest rate expectations have increased but only by 0.25%, in both the euro area and the US. One concern is that the market is still expecting interest rates to be cut in the US this year. This may come to pass but it is ambitious. The deterioration in bond markets has been largely driven by one month’s data on economic growth and inflation. From here to the end of the year, we believe both the economic growth and inflation data will be on average, softer. Therefore, we are not panicking about the fixed income markets but rather wonder if this is an opportunity to increase exposure.

- Equity markets have been well behaved in this environment. Year-to-Date, in euro terms, the world index is up close to 7% and just over 1% month-to-date. December was a very weak month for equity markets. Better economic growth data sparked a small recovery, but it is hard to see where growth can be found going forward. Last week good growth data turned out to be bad news for equities as it is now driving up interest rate expectations. Weaker growth data should improve the interest rate outlook but brings doubts over earnings growth. Either way it looks tough for equities to move higher from here.

Macro views

Retail Sales data in the US showed a strong recovery in January. Headline Retail Sales were up 3.0% month-on-month, but core level was also rising 1.7%. Retail Sales were down for the previous two months of 2022 so perhaps there was pent-up demand building. Households did receive a big boost to incomes during the month as cost-of-living adjustments were added to welfare payments, so this level of growth is unlikely to be maintained.

The much anticipated, or feared, inflation report was released in the US last week. There was a worry that this month’s release might give a surprise especially when some recent data from the US had been showing a relatively robust economy. As it turned out it was quite uneventful, coming in very close to expectations. Both core and headline inflation ticked down 0.1% on a year-on-year basis. Core goods prices were up slightly on the month, bucking the recent trend of monthly decline which was disappointing for consumers.

We got updates on the industrial sector of economies with Industrial Production data released in the US (for January) and euro area (for December). Both came in below expectations. In the euro area production was down 1.1% month-on-month and in the US it was flat. The US was depressed by a big drop in utility output which is quite weather dependent. Manufacturing output was up 1% month-on-month. Momentum is slowing, which is to be expected as consumption has been switching from goods to services.

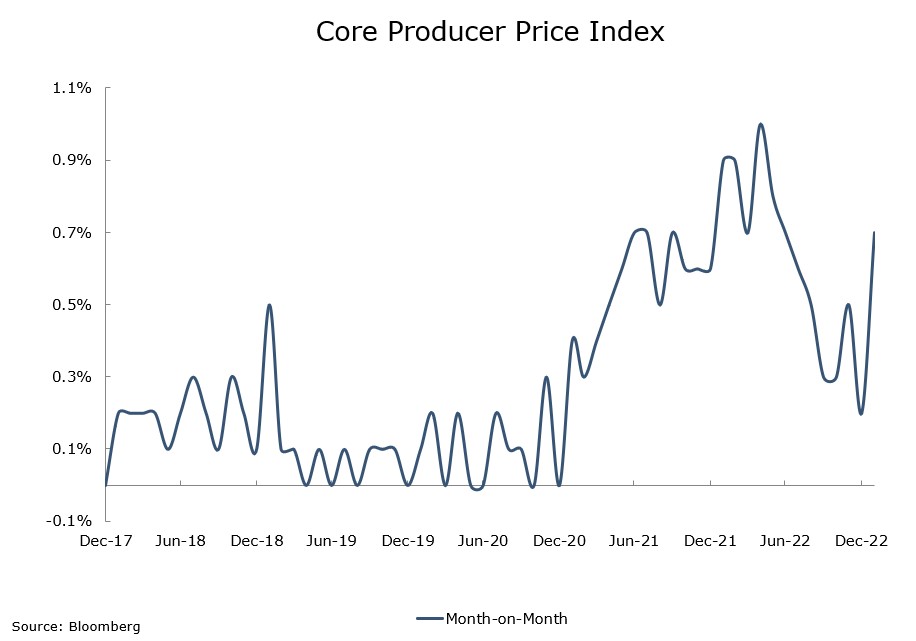

Chart of the week: Things don't go down in a straight line

All eyes were on the Consumer Price Index report from the US, but it is Producer Prices data which moved the market. Producer Price inflation in the US peaked last March and has been steadily decelerating since. January’s data showed a significant pick-up, spread broadly across all categories in both the month-on-month rate and year-on-year rate. It is only one data point, and it could reverse next month but it reminds us that the journey down for inflation is not a ‘straight line’ which means interest rates are held higher for longer.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |