What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

February proved to be a challenging month, both fixed income and equities delivered negative returns. Dataflow indicated a resurgence in inflationary pressures and hence a notable increase in interest rate expectations and the length of time that interest rates will remain in restrictive territory. We still believe that 2023 will see a drop in inflation but we cannot expect to see it every single month. If we are wrong, then central banks will have their ‘foot on the break’ even harder than currently forecast and equities look more vulnerable to that then fixed income, as that impacts on an anaemic global economy.

Within fixed income markets investment grade corporate debt is again outperforming, although the returns were negative for February (-1.4%). The higher running yield, narrowing credit spreads due to better growth data and duration, drove the better performance. We have been increasing our fixed income exposure as believe we are passing the peak in inflation and could add some positive returns to clients’ portfolios. However, we were always uncertain about the speed at which inflation would subside and hence how long policy rates would remain elevated. Hence, we have kept duration short and believe that is still the best policy.

Equity markets continue to have a cyclical bias: industrials, financials and IT were the best performing sectors in February. The more resilient performance from the global economy has been the main reason behind this better performance. However, this better growth out-turn along with stickier inflation means more monetary tightening and a weaker economy down the road. Better to remain defensive with that background.

Macro views

Last week in the US, surveys from the Institute for Supply Management (ISM) were released and told the same narrative that we have previously seen from other data releases. The US economy may have been softening in the latter stages of 2022, but it has started 2023 on an uptrend. The Services survey was well into expansion territory and while Manufacturing is still below 50, it is up month-on-month and if that trend is continued then we are past the worst for the manufacturing economy. That is good news for the outlook on economic growth.

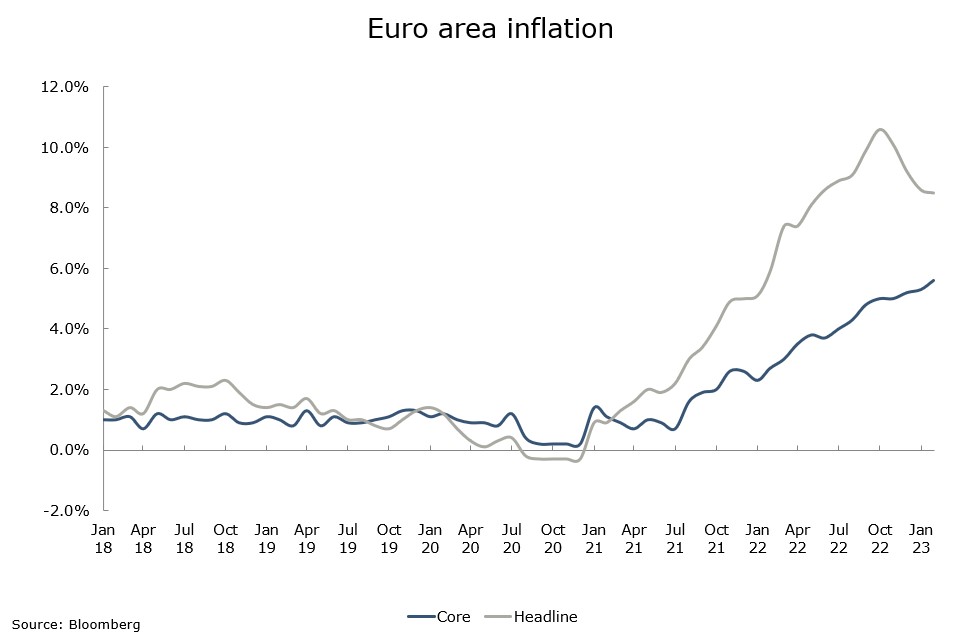

The element from the Manufacturing survey that grabbed attention and did not please, was the spike up in the Prices Paid Index. That it increased is not the major issue, it cannot keep going down for ever, but that it jumped above 50, disturbed people. Prices being paid are rising again on a month-on-month basis. This was not the only piece of news we got showing inflationary pressures are still there. The CPI index for the euro area last week (see chart of the week below) showed core inflation going to a new high.

In China we got evidence that the reopening is in full swing. The Purchasing Managers Index (PMI) for the country jumped significantly last month and there were thoughts that the move was so big there would be a bit of a cooling in the February releases. However, that was not the case. Both the Manufacturing and the Services PMI’s went further above 50. Added to this was the first monthly increase in new home sales in China in almost 2 years, which added to the optimism around outlook for the Chinese economy.

Chart of the week: Still sticky

There was no joy in this month’s inflation report from the euro area. Core inflation took another step higher when we thought it might be flattening out. Most disappointing was the pickup in core goods inflation (+0.8% month-on-month) at a time when demand had been switching from goods to services. Headline inflation, which was decelerating for the last number of months, also proved stickier holding steady at over 8% year-on-year. The net effect is that interest rate expectations in the euro area have taken another jump. The policy rate is now expected to peak at 4.0% as against 3.5% at the end of January.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |