What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

- It was a more subdued week across financial markets. Bond markets continued to digest the strong data we got from the US the week at the end of January with yields drifting higher. The biggest change was the reduction in the amount of interest rate cuts expected over the next 12 months. This we view as healthy because the US market was getting ahead of itself in the timing of interest rates cuts. With core inflation nearly 4% above target, expecting interest rates to be cut by 2% in 2024 looked ambitious to us.

- We are now nearly two thirds of the way through the US reporting season, and it has been uninspiring. There were no major calamities, which gave some relief but there was nothing to celebrate. So far, earnings in the US are down 2% year-on-year and are only 1% better than forecast, which is the smallest level of surprise we have had since 2019. Looking at the details the sectors which performed best against expectations are Consumer Discretionary, Healthcare and Utilities. There is a defensive element to the companies that are performing against expectations, which we expect to continue.

- In Europe, just over one third of companies have reported. Overall earnings are down 2% but this is flattered by a strong performance from the Energy sector. European profits that exclude Energy are down 10%. Actual results give a small bit of joy at 2% higher than expected, but it is still a low level relative to history. The standout performance was from the financial sector, which had the boost of higher rates, now past. Profit surprise will be harder to achieve in future quarters this year.

Macro views

- Euro area Retail Sales for December showed a weak end to the year. They were down 2.7%, slightly worse than the forecast decline of 2.5%. Overall Retail Sales dropped 4.4% from the third quarter to fourth quarter. The implications for the broad economy may not be severe. There has been a shift in consumption from goods to services and Retail Sales is heavily skewed to goods consumption. It did appear that euro area consumers were exercising caution about how the winter would impact on energy prices but that has now passed. Retail Sales are likely to show growth as we travel through 2023.

- Federal Reserve Chairman Jerome Powell had good and bad news last week. Powell spoke of easier financial conditions and signs of deflation. All of that was good and part of the recent catalyst for the recovery in financial markets. Powell warned however, that if we continue to get strong data, such as the last Payrolls number, rates may have to go higher than the current forecast of 5.0 – 5.25%. Good news can sometimes be bad news.

- The University of Michigan Survey of Consumer Sentiment was released. It was up month-on-month and almost back to where it was at the start of 2022. However, it still lies well below levels of 2021 despite a very low unemployment level. One year inflation expectations did pick up, but the 5-year expectations held steady at 2.9%. There was nothing in the report to impact on the Federal Reserve or alter forecasts.

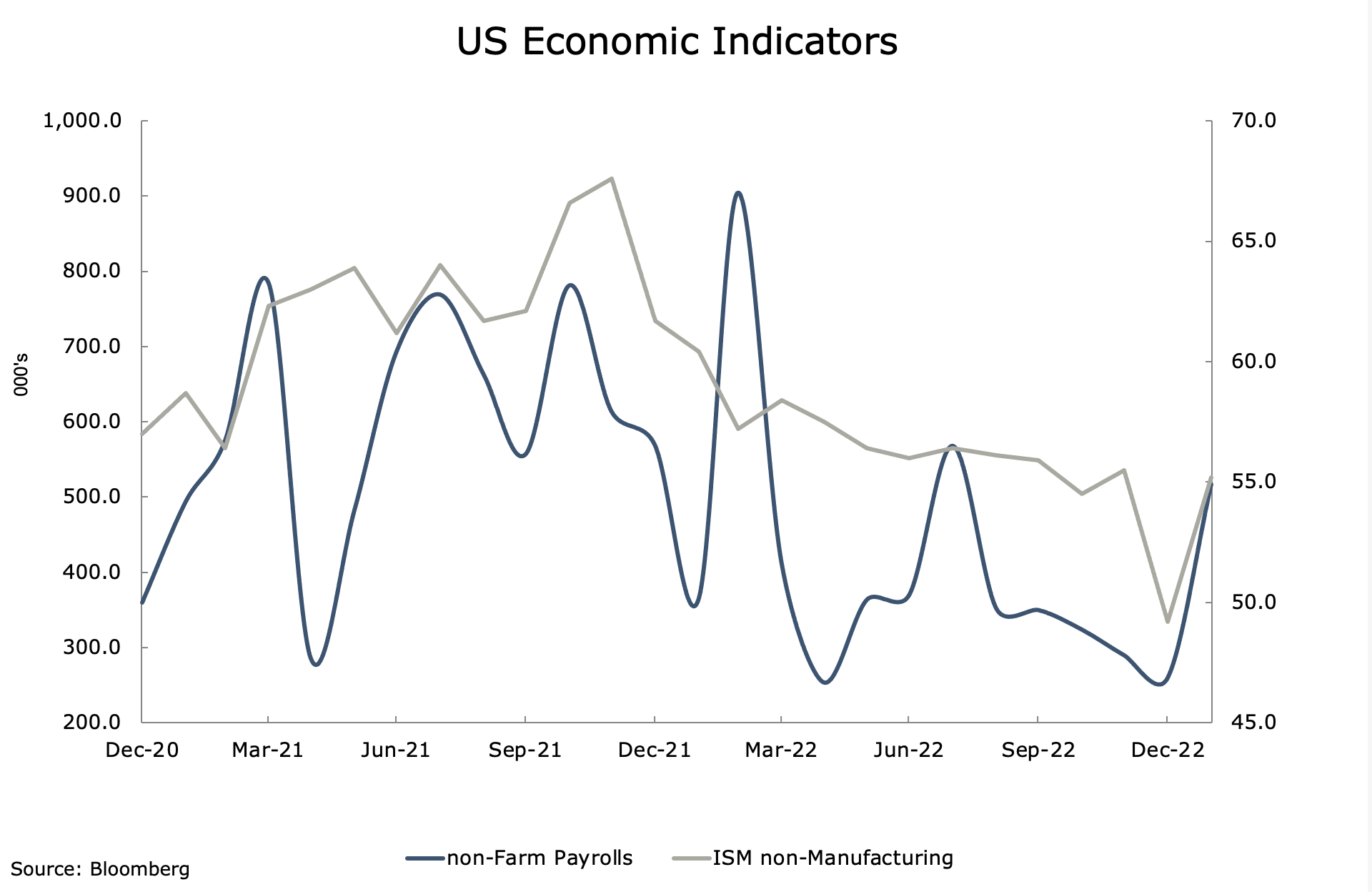

Chart of the week: The US Conundrum

The data flow from the US was showing a steady slowing in the economy. However, two key indicators released the week at the end of January, showed unusual strength. The non-Farm Payrolls showed a big spike in job creation. This was one of the strongest figures we have had over the last 12 months and well above a cycle average. The ISM non-Manufacturing survey dropped sharply in January and there was an expectation of some level of rebound. It has rebounded all the way back to the December level, which gives the US bond market pause as it now must rethink when and where US interest rates will peak.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |