What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

The Federal Reserve Chairman, Jerome Powell delivered a soothing press conference last week. Chair Powell’s comments were quite dovish, despite raising rates by 25 basis points(bps), as expected. The Fed are starting to see disinflation even with a strong labour market. Following the last Federal Open Market Committee meeting, the biggest change was dismissal of concern about the recent easing in financial conditions.

The European Central Bank had its policy meeting and increased rates by 50bps. It also pre-announced another 50bps increase for March. Future rates will be set on a meeting-by-meeting basis and will be data dependent. It has maintained the line that "interest rates will still have to rise significantly at a steady pace". The ECB remains in aggressive mode, and it is not as clear where interest rates will peak as it is in the US.

Financial markets were in a good mood post the Powell press conference, but this came to a halt after stronger economic data (see below) was released on Friday. More momentum in the US economy means less certainty about when interest rates will peak. While economic growth in the short term is good, what it means for longer term growth is that interest rates are kept higher for longer. The resulting action is to keep duration short within fixed income (with the outlook on interest rates clouded) and defensive within equities (the longer term growth rate remains uncertain).

Macro views

Last week the data released painted a stronger picture of the US economy. The ISM Manufacturing Index was weak and worse again at 47.8 indicates that the manufacturing sector is in contraction territory. However, the Non-manufacturing ISM, which covers a larger section of the economy rebounded very strongly from a weak January reading. At over 55, it appears the services sector is in expansion mode. Along with this, there was a significant pick-up in job creation with a large non-Farm Payrolls number.

Meanwhile there was good news about inflation from the US Employment Cost Index. Costs were up 5.1% year-on-year but only 1% in the fourth quarter. Despite the continuing tightness in the labour market, Employment Cost inflation has declined for three quarters in a row which is not indicative of a wage price spiral.

The euro zone’s fourth quarter GDP did not contract, although the rate of expansion was paltry (0.1% quarter-on-quarter). The detail was not encouraging. A big drop in imports was the main driver of the move into expansion, not what one would expect. Indeed, real consumption was declining towards the end of the quarter which doesn’t bode well for 2023.

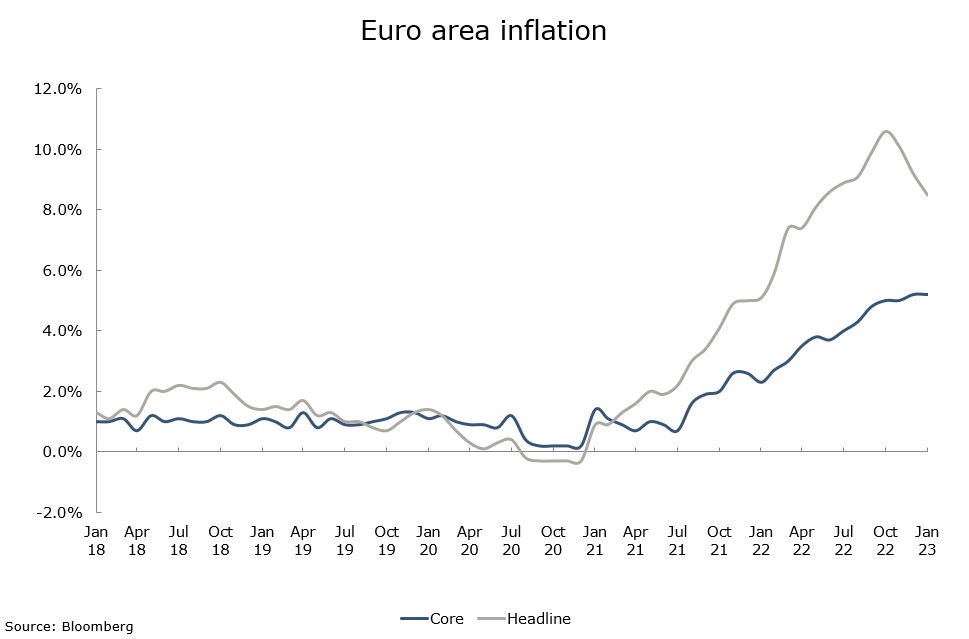

Chart of the week: Remaining stubborn

The inflation report from the euro zone was mixed. Headline inflation was down more than expected giving relief to the consumer, as it increases real purchasing power. Core inflation is proving more stubborn, up 0.5% month-on-month and holding at 5.2% year-on-year. These statistics are coming from goods price inflation as services prices were only up 0.1% month-on-month. Goods prices are declining elsewhere in the world so this is surprising and could change quickly. The report will keep the ECB on watch for another month.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |