What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

- A sense of calm appeared across financial markets last week, but we have ended the quarter on a turbulent note as the banking sector comes back in focus. Interest rate spreads on bank debts are widening again as investors fret about the financial strength of individual banks. Our Asset Allocation Committee met to discuss the banking issues. Everything is caveated by ‘what we know today’. The Committee felt there was enough evidence that most of the issues were company specific and the reaction of authorities was sufficiently large and quick to stop these problems becoming more systemic. It has been advocating a cautious stance and recent events justify a more negative viewpoint.

- Our Investment team are hosting a 30 minute call this Wednesday on the fallout from the banking sector on investment markets and the implications for the macroeconomic outlook for the rest of the year. You can register here.

- There was keen interest on what the Federal Reserve would do at its policy meeting. Like the European Central Bank, it kept to the course it has outlined prior to the recent volatility. It raised the policy rate by 0.25% but the language did soften from ‘increases in the target range will be appropriate’ to ‘some additional policy firming may be appropriate’. Many members felt that the terminal interest rate would be lower than thought at the last meeting. The market reaction was to bring interest rate cuts in 2023 back on the agenda. But the Federal Reserve did increase its inflation forecasts for 2023 and 2024 so the markets could be disappointed on this expectation.

Macro views

- There were a couple of interesting developments in the UK last week. Firstly, in the inflation report both core and headline inflation moved to a new high in this cycle. It was distorted somewhat but it shows price pressures are still extreme this side of the Atlantic. Secondly, the Bank of England met and increased interest rates but quoted a stronger growth environment, both domestic and internationally, as the reason for this rise. This is the problem facing equity markets: better growth could be met with higher interest rates.

- There was a big bounce in business sentiment in the euro area. The composite PMI (Purchasing Manager’s Index) rose to 54.4, a level we have not seen in almost a year and undoing all of the decline since Russia’s invasion of Ukraine. All the improvement came from the services sector with manufacturing flat month-on-month. The euro area consumer confidence survey was weaker declining in the month, but this could include some response to the recent banking turmoil. The drop was less than a point. The surveys still portray a resilient euro area economy.

- Mixed signals came from the US economy. Consumer sentiment fell in March, which does cover some of the period of banking turbulence, but still was much weaker than expected. Inflation expectations over one and five years also dropped, which was welcome. Industrial Production was flat month-on-month in February after a strong bounce in January. Output was depressed by low utility given the milder winter. The US started the year on a strong note. These data points are saying the momentum may have eased but the economy is still quite resilient.

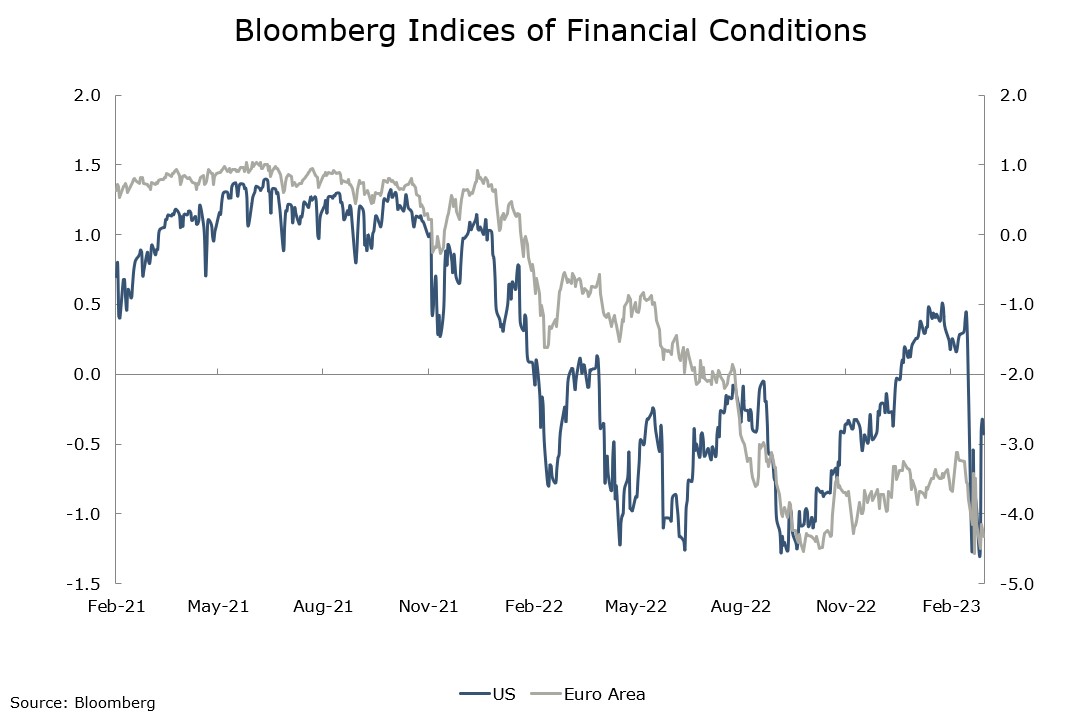

Chart of the week: Are markets doing the central bank's job?

Hopes are growing that the tightening in financial conditions brought on by the recent turmoil in the banking sector would push central banks towards a pause in interest rate hikes. The chart above shows one measure of financial conditions, the lower it is the tighter conditions become. A couple of things to note from it: firstly, conditions were equally tight last September/October and that did not bother central banks. Secondly, these measures are volatile, we have already reversed half of the tightening in the US. It is unlikely central banks will respond quickly to movements like these.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |