What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

- It was another good week for financial markets. World equities were up nearly 2% in euro terms and the 10-year yield in the euro area dropped more than one quarter of a percent. All the focus for markets was on inflation data (which I’ll cover later) and comments from Federal Reserve Governors. Last week left November as the strongest month for markets this year: world equities are up nearly 6% and the euro area bond market has delivered almost 2%.

- There were a number of Federal Reserve Governors speaking last week but the one that caught most attention was Governor Waller, who up to now was one of the most hawkish members of the interest rate setting committee (FOMC). In his speech, he said that he was “increasingly confident that policy is currently well positioned to slow the economy and get inflation back to two percent.” That is as close as you will get to saying the hikes are over. Other members who spoke were more cautious in their statements. Chair Powell was speaking at the end of the week and said monetary policy was ‘very restrictive’, that sounds like the next move is down.

- OPEC+ held their meeting and the members did agree to the Saudi request to cut another 1m barrels per day off planned production levels. In reaction, the oil price fell $2, giving up all its gains going into the meeting. The reason for the negative reaction is that all of this extra production cut is to come from outside Saudi Arabia and some of these countries are not meeting their quota levels as they stand. A subdued oil price is good news for the global economy and financial markets.

Macro views

- There was more good news on inflation in the euro area with the release of November’s figures. Headline inflation dropped to 2.4% year-on-year against forecasts of 2.7%. Core inflation also took a big step down to 3.6% year-on-year, with core goods inflation now below 3%. Core inflation was expected to come in at 3.9%. The market reaction to the figures was muted but then bonds have moved down so much over the last six weeks that it is not really surprising. There is a lot of good news built into bond yields at the moment.

- Good news from the US as well. Core PCE inflation (the measure which the Federal Reserve follows closely) fell to 3.5% year-on-year in October. If we look at the last three months, the annualised rate of core inflation is now down to 2.4%, not far from target. No wonder Federal Reserve Governors are saying that maybe they have done enough for now.

- Other data from the US indicate a slowing in the fourth quarter from the heady growth rates seen in Q3. Total consumer spending in October rose 0.2% month-on-month, down from the 0.7% achieved in September. Meanwhile, consumer confidence was disclosed up month-on-month, but this is only after October’s figure was revised downwards. Taking the unrevised figure for October consumer confidence was flat month-on-month. Actual consumption continues to paint a stronger picture than consumer sentiment.

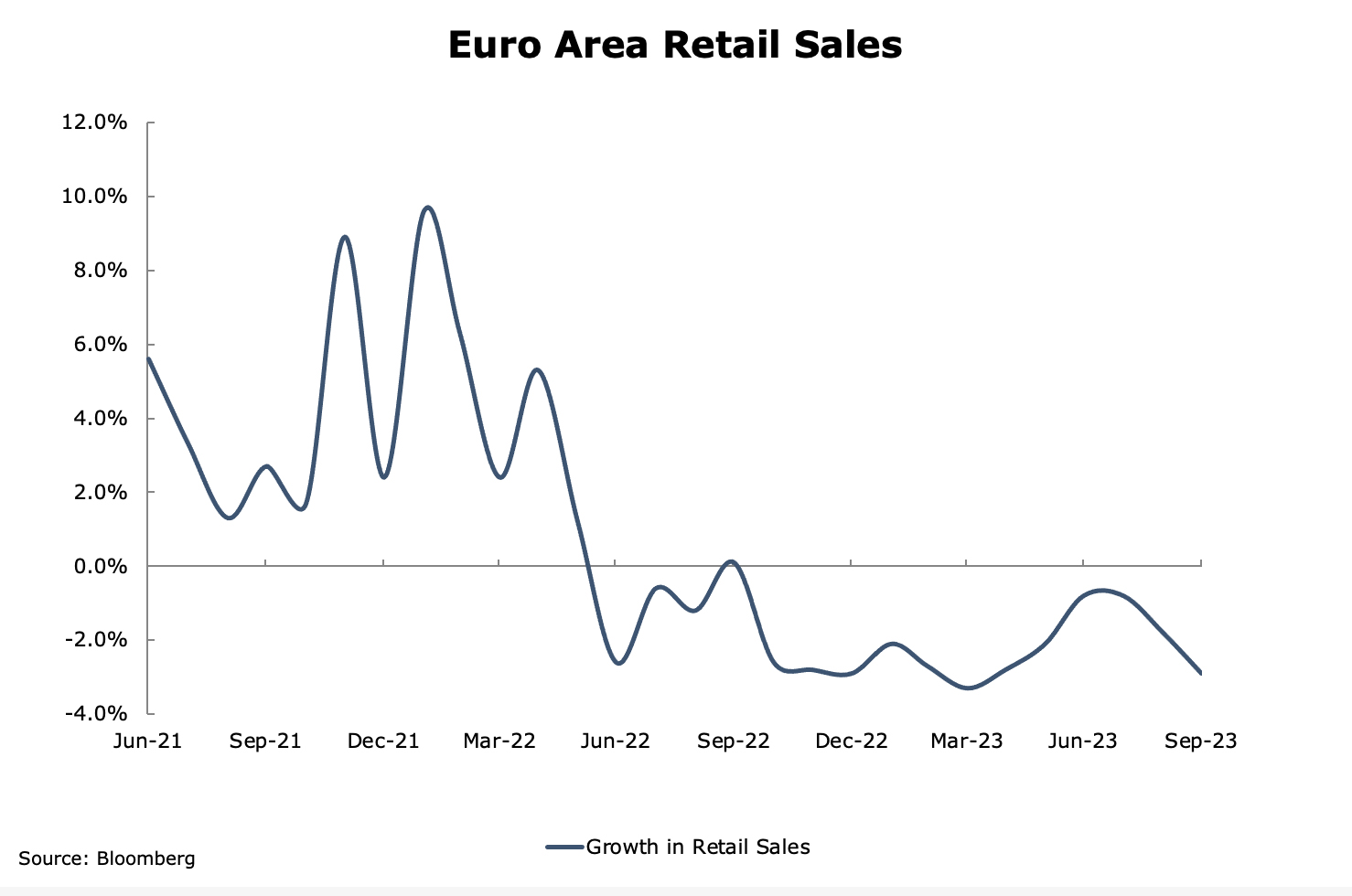

Chart of the week: They need to start spending

Through this year, the euro area economy has been underperforming the US economy by quite a margin. We knew that the energy crisis sparked by Russia’s invasion of Ukraine would lead to a more challenging environment for the euro area in 2022 and the early part of 2023. But that is a year ago now, and the euro area economy is still struggling. One of the reasons is a consumer who is refusing to spend. As you can see in the chart, retail sales growth took a leg down after the Russian invasion, but it has kept falling year-on-year every month since then. Until this turns, the outlook for the region remains dull.

Looking back on 2023

For equity markets, the avoidance of a recession in 2023 in the developed world was a major positive. For bond markets, increased confidence that we have reached the peak in interest rates, at least in the developed world, was a boost. That said, returns were held back by the realisation that interest rates are likely to stay higher for longer.

Global growth is expected to come in at 2.8% for this year, not much below trend, and every region delivered higher growth than forecast. In the US, the consumer was much stronger than expected and fiscal policy gave a bigger boost than forecast. Meanwhile, in the euro area, it was the avoidance of problems and an energy-related crunch, rather than a positive influence that ended up delivering the better outcome. In China, the removal of pandemic restrictions delivered a boost.

To read my full review of markets for 2023, click here.

Please note: this is final edition of Market Pulse for 2023. We'll be back in 2024 with more investment updates and insights.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |

This is a marketing communication.