What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

- The quarter has ended on a calmer note and despite the turbulence during March, the first quarter was a good one for equities, returning almost over 5%. For the quarter, last year’s losers (IT; Communications and Consumer Discretionary) were the leaders. The recent risk aversion in March did deliver some difference, defensive sectors outperformed their counterparts.

- It was also a good quarter for the fixed income markets as the euro area market returned almost 3%. The first quarter’s volatility did lead to a ‘flight to safety’ aiding bond markets. As a result, markets now expect interest rate cuts in the US and euro area over the next 12 months. This led to long duration bonds outperforming. Corporate debt did trail sovereign debt during the quarter but still gave a healthy return of 1.8%. Risk aversion and long duration were the primary drivers of the sovereign outperformance.

- In the last month, we have seen the impact of the monetary tightening that started last year, and it is likely that there is more to come. This keeps us in a cautious mode, underweight and defensively positioned within equities. We would not be so optimistic about interest rate cuts over the next year as the inflation is still proving more persistent that people expected. Consequently, we still favour short duration and corporates, where the higher running yield is attractive.

Macro views

- The primary data release last week was the inflation report from the euro area. It did not make for pleasant reading, but the bad news was expected, so the market impact was limited. On the bright side headline inflation tumbled on an annual basis from 8.5% in February to 6.9% in March. On the other side, core inflation accelerated again on an annual basis to reach a new high in this cycle of 5.7%. Accelerating Service inflation is the main driver of this and should keep the ECB on a tightening track. This is why we think the probability of interest rate cuts over the next 12 months in the euro area is very low.

- In the US, the PCE (Personal Consumer Expectations) price indices were released. This is the favourite price measure of the Federal Reserve. This was better than expected with core prices up 0.3% month-on-month and a cut to last month’s estimate. It is welcome news to see inflation data coming in better than expected. However, the year-on-year rate at 5% is still well above target levels so the risk to interest rates remains to the upside.

- There was strong data from China. The Purchasing Managers Indices (PMI’s) were released and there was another big jump in the Services PMI (up from 56.3% to 58.2%) with the output and orders components leading the rise. The Manufacturing PMI was down from 52.6% to 51.9% but this was encouraging as the weakness was the output prices component which indicated prices are falling on a month-on-month basis. The surveys indicated that the reopening is progressing well in China and that the rebound in the economy is consumer and domestic led.

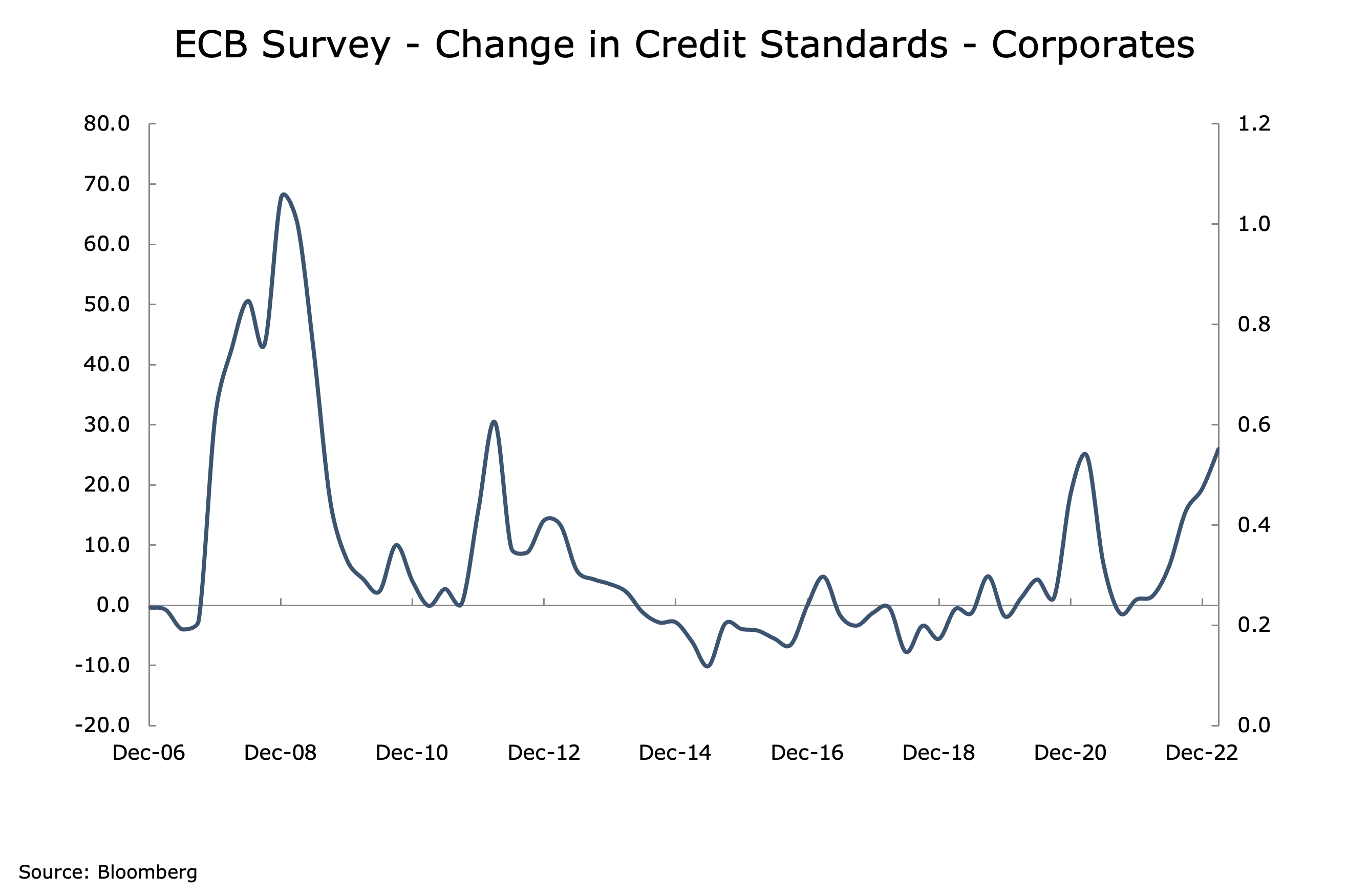

Chart of the week: Leading standards heading to extreme level

In the euro area banks had been tightening lending standards, reacting to the substantial increase in interest rates and the downgrades economic growth. This is the highest level we have seen outside the euro crisis or severe recession. The last two times we got to these levels there was a rapid reversal. Lending standards may tighten and go to extreme levels as interest rates rise further and markets deal with the recent bank turmoil. Monetary conditions are set to tighten further, which is what makes us cautious on equity markets.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |