What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

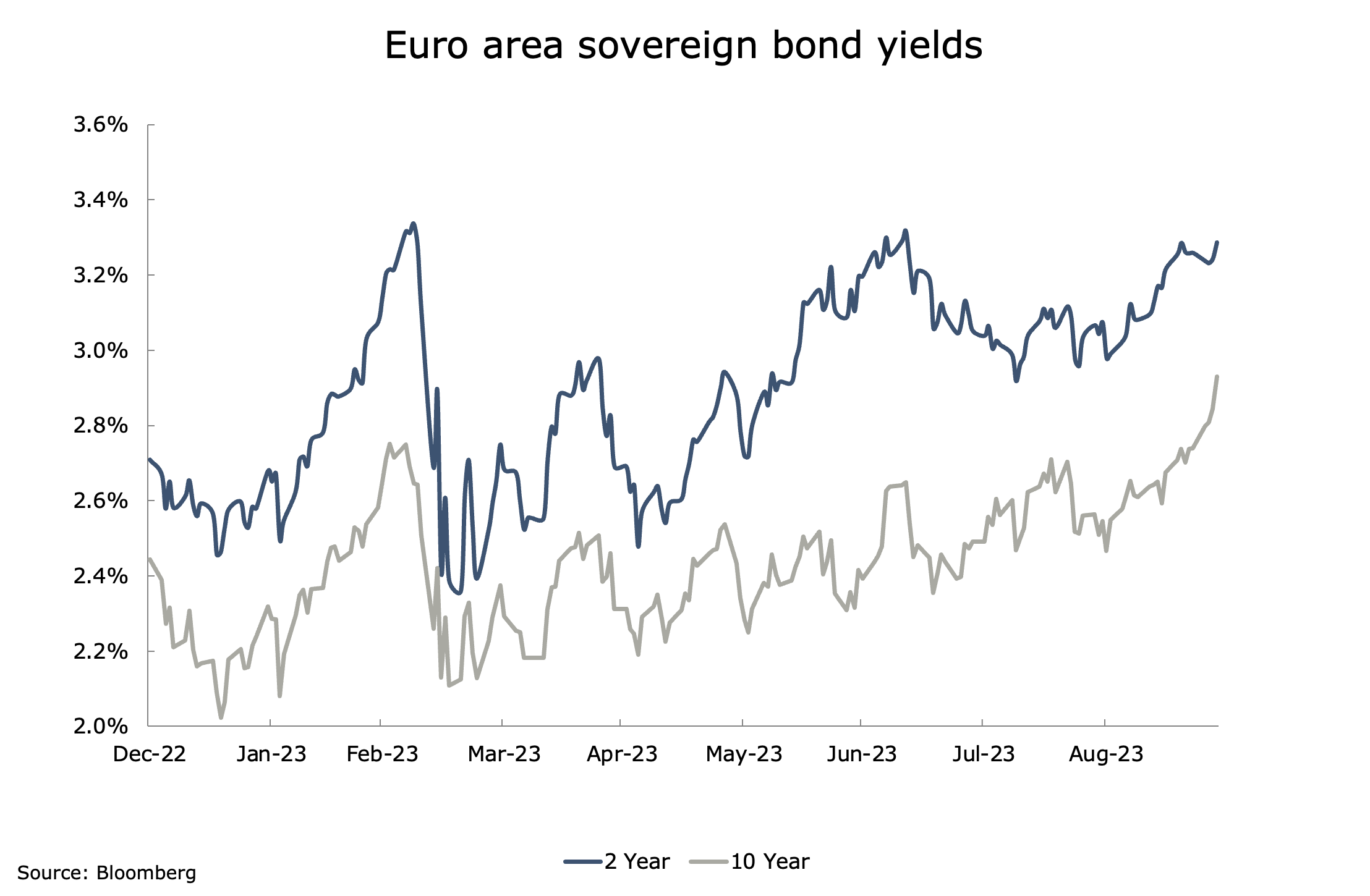

- September was a down month for markets, which was caused in part by the bond markets. The euro area bond market was down 2.1% in the month as markets continued to adjust to the idea of interest rates being ‘higher for longer’. The main pain for bond markets was in longer dated sovereigns. This is why we have been maintaining a bias for short dated. Holding corporate debt gives some greater protection through a higher running yield. September’s developments confirms the wisdom of our fixed income strategy.

- Returns from equity markets were not as bad, world equities were down 1.6% in euro terms. Only one sector was up in September: Energy was the best performer due to the spike in the oil price. Financials were next, thanks to the belief that interest rates may have peaked gained traction. At the bottom of the table was IT, pulled down by highly rated companies suffering from the higher bond yield. The next worst was Consumer Discretionary, under pressure from the higher oil price. Oil price was as big an influence on sector ranking as interest rates were in September. We are coming into the third quarter earnings season, it should be satisfactory, but we will be watching to see if there is any great movement to 2024 forecasts after it.

- One bit of good news that came out last week was the passing of a funding bill in the US which avoids a government shutdown. Unfortunately, the bill is only a short-term funding measure, the issue will return in mid-November. We believe that it will only affect sentiment rather than alter any fundamentals of the US economy.

Macro views

- The key release last week was the inflation data from the euro area, which was benign. Core inflation was up 0.2% month-on-month, down from 0.3% in the previous month. The year-on-year rate dropped from 5.3% to 4.5%, which was lower than the forecast rate of 4.8%. The headline rate also slowed more than expected, dropping from 5.2% to 4.3% year-on-year. There were big drops in both goods and services inflation which should please the ECB and would add to the argument for a pause in rate rises.

- We had a range of data from the US with a couple of noteworthy ones. The PCE (Personal Consumption Expenditure) price indices, which are the favoured measure of inflation for the Federal Reserve, were released last week. The core index was up just over 0.1% month-on-month which is the lowest change since November 2020. Meanwhile, personal consumption figures showed an almost flat return month-on-month in August. Cooling inflation and a subdued consumer could push the Federal Reserve towards a pause.

- There was another data point from China last week which re-enforced the idea that the economy may be stabilising: industrial profits were up over 17% year-on year in August. This is a big contrast from the 6.7% year-on-year decline in July and it is the first monthly growth in industrial profits we have seen this year. This good news also follows better Industrial Production and Retail Sales releases, so a rosier picture is emerging.

Chart of the week: Keep it short

We have been saying for some time now to keep your duration short in the bond market, the chart above shows why. During the recent weakness all yields are up, but short dated yields have moved up by much less. Indeed, you can see that the 10-year yield moved to a new high in the recent down period while the 2-year remained within its range. The shorter dated bonds have gone further in pricing in the interest rate environment than longer dated ones. The two-year yield is higher so while the price is moving around, you are getting greater protection from the higher running yield.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |