Goodbody has acted as sole financial adviser to EirGrid since 2016. Last year, Goodbody advised EirGrid on a €800m debt fundraising to fund the construction of the Celtic Interconnector with the project reaching financial close in November 2022.

EirGrid is the Transmission System Operator (TSO) of the onshore electricity grid on the island of Ireland. It is also the electricity market operator on the island of Ireland. EirGrid owns and operates the East West Interconnector between Ireland and Great Britain. It has also been designated as the operator and owner of Ireland’s future offshore grid. EirGrid is an Irish commercial semi-state company.

What is the Celtic Interconnector and what parties are developing the project?

The Celtic Interconnector is a 700 MW electricity link connecting Ireland and France. It is being jointly developed by EirGrid, the Irish TSO, and Réseau de Transport d’Électricité (RTÉ), the French TSO and Transmission Asset Owner. It will be the first direct electricity interconnector between Ireland and Continental Europe. Currently, Ireland’s electricity system is only connected directly to the UK. Since the UK’s departure from the EU, this has meant that Ireland has no direct connectivity to the EU - the EU has a target of 15% interconnectivity between all EU counties by 2030.

What are the benefits of interconnection?

Interconnection across EU member states facilitates the movement of electricity flows on a European scale and ultimately aids market price convergence. In addition, it provides for the integration of renewable generation and facilitates decarbonisation, by enabling cross-border exchanges and therefore maximising output and minimising curtailment of low carbon and renewable generation. It also helps security of supply to be maintained and strengthened as we transition to a decarbonised power system.

Tell us about Goodbody’s involvement in the earlier stages of the project?

The long-term nature of infrastructure projects is evident, in that Goodbody was initially appointed as financial adviser to EirGrid in 2016 and was immediately tasked to prepare a business case and financial strategy report to assist with EirGrid’s evaluation of the Celtic project. Detailed work between EirGrid and RTÉ, led to the submission of the investment request to the two National Regulatory Authorities in 2018.

Given the strategic importance of the Celtic project, the European Commission consider it a Project of Common Interest. This made access to planning permission and permits more streamlined and facilitated access to a grant from the Connecting Europe Facility, with EirGrid and RTÉ awarded a grant of c.€530 million by CINEA to fund the construction of the Celtic Interconnector.

A key aspect of the project that had to be negotiated was the ownership structure and funding parameters which formed the basis of the cross-border cost allocation (CBCA) request. Following their review, the National Regulatory Authorities of Ireland and France published their CBCA decision which provided a framework for the sharing of the project costs. This resulted in a 65-35 cost split (Ireland-France), reflecting the estimated relative benefits of the project, with costs above €1.18bn to be split 50-50. A new company, Celtic Interconnector DAC (CIDAC) was established with EirGrid and RTÉ owning 50% each. CIDAC (as the JV between EirGrid and RTÉ) procured the EPC contracts for delivery of the project.

How was the debt financing structured and the successful banks selected?

EirGrid and RTÉ were separately responsible for funding their respective portions of the project. Securing confirmation of the regulatory framework for EirGrid’s share of the project from the Commission for Regulation of Utilities (CRU) was critical to allow EirGrid raise sufficient debt funding as it gave certainty on revenue and de-risked the project. During the construction phase EirGrid is permitted to recover the costs of servicing its debt. During the operational phase a Regulatory Asset Base (RAB) WACC model will apply. The opening RAB will be set by CRU following a post construction review while the WACC will be set every 5 years as part of EirGrid’s price review process. The RAB is depreciated on a straight-line basis over 25 years. EirGrid is also permitted to recover its operational costs.

Goodbody was tasked with conducting a competition to secure EirGrid’s portion of the debt. It was decided that a 30-year term loan was required which reflected the five-year construction period and the 25-year RAB depreciation period. Drawdowns were staggered over the five-year construction period, in line with capex spend. In addition, it was determined that a 5 year €200m revolving credit facility was required (with two one-year extension options) to fund working capital for tax, grant and construction cost bridging.

Due to the long tenor of the term loan, Goodbody approached a mix of banks and private placement providers. The financing structure was a hybrid, involving both corporate funding and project finance aspects. The debt raise was conducted at an EirGrid plc level where the project revenues underpinning the financing are collected.

After a two-stage funding process involving detailed financial, tax, technical, legal and insurance due diligence, the European Investment Bank (EIB) and Danske Bank were appointed to each provide €300m of the €600m term loan, while Barclays and BNP Paribas won the RCF mandate, providing €100m each. The EIB loan is at a fixed rate while the loan from Danske Bank has a floating interest rate. Barclays and BNP Paribas provided an interest rate swap so that EirGrid’s interest rate exposure in relation to Danske’s term loan could be hedged.

What is the current status of the project?

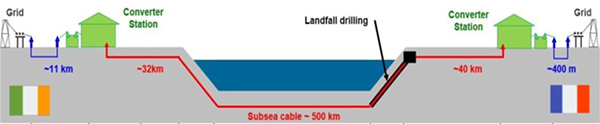

EirGrid’s debt financing reached financial close in November 2022, and this was shortly followed by the signing of contracts with Siemens Energy for the development of converter stations and with Nexans, which will design and install the cable between the two countries. The overall cost of the project is estimated at €1.6bn. Construction is underway with the interconnector expected to be operational in 2027.

This is a marketing communication.