The COVID-19 pandemic has caused a resurgence in UK Capital Markets activity, with money raised by listed companies in 2020 reaching its highest level in more than a decade.

Analysis of London Stock Exchange data on further issues from investment bank Goodbody shows that as of 30th October, listed companies have raised more than £26bn (£26.234bn) from investors on the London Stock Exchange’s Main Market and Alternative Investment Market, the highest level since 2009*. In total, 2020 has seen 463 companies complete transactions to raise additional capital.

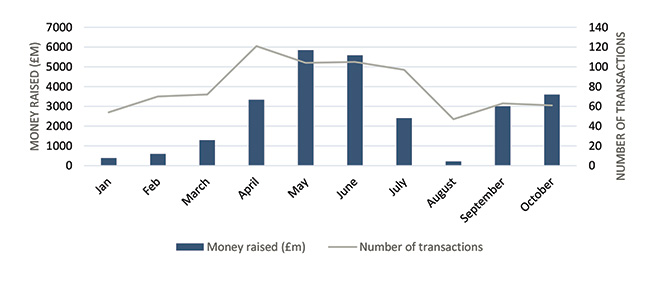

The distribution of transactions has closely mirrored the impact of the pandemic, with both the volume and magnitude of transactions peaking in April following the first UK lockdown, and beginning to increase once again as the second wave of cases gathers momentum and regional restrictions are implemented.

Money raised and transaction volume

“In the face of crisis, we have seen investors respond brilliantly to the needs of publicly listed companies. In recent years, a rise of passive funds and a trend towards de-equitisation has taken the focus away from the vital role active investors play in keeping equity capital markets healthy for listed companies. This year has firmly reversed that trend, and through institutional and retail investors giving their backing to companies at this difficult time, thousands of jobs have been protected and businesses can plan for the future.” Piers Coombs, Head of Goodbody UK.

Sector analysis

Consumer Discretionary sectors saw the greatest value of capital raised, raising a total of £11.4bn in the period. This was followed by Industrials (£4.2bn), which includes aircraft engine manufacturer Rolls Royce, and Financials (£3.9bn), which also saw the highest number of companies raising capital (95).

| Sector | Money Raised (£bn) | Number of companies raising capital |

| Consumer Discretionary | 11.4 | 70 |

| Industrials | 4.2 | 46 |

| Financials | 3.9 | 95 |

| Real Estate | 3.1 | 18 |

| Healthcare | 1.1 | 49 |

| Technology | 0.9 | 30 |

| Consumer Staples | 0.8 | 5 |

Protecting balance sheets

The Consumer Discretionary sectors, which include automobile, consumer services, travel and leisure, saw the most capital raised, with 70 companies raising a total of £11.4bn.

This included several of the largest deals of the year to date, including Compass Group, the FTSE 100 catering group, which raised a total of £2bn from both retail and institutional investors.

In the travel and leisure sector alone, 30 companies conducted further equity issues, raising £5.5bn, including British Airways owner, International Consolidated Airlines Group, which raised £1.3bn. More recently in November, The Rank Group raised £70m.

Opportunities for growth

Companies in or with exposure to fast growth technology have raised capital in more positive circumstances.

Venture firm Draper Esprit Plc raised a further £110m in October to continue the growth of its portfolio amidst the increase in opportunities it has been seeing to invest in technology businesses.

In the video gaming sector, where social restrictions have accelerated growth, UK-listed Keywords Studios raised £100m in May and was the first example of a listed company since the onset of COVID-19 to raise equity for acquisitions, a key part of its growth strategy.

What is positive to see is that this support has been across the board. The sectors that have raised the most capital will come as no surprise, as retail, travel and leisure businesses have all looked to repair their balance sheets. However, transactions have not been limited to those struggling to survive. We have also seen great examples across consumer staples, technology and gaming where companies have raised capital to take advantage of surging demand to grow their businesses, demonstrating the vital role that public markets play in accelerating growth.

* London Stock Exchange Further Issues, as at 30th October 2020, available at www.londonstockexchange.com/reports?lang=en&tab=further-issues

This is a marketing communication.