An analysis of follow-on issues on the London Stock Exchange Main Market and Alternative Investment Market to identity the trends shaping capital raising activity from London-listed businesses.

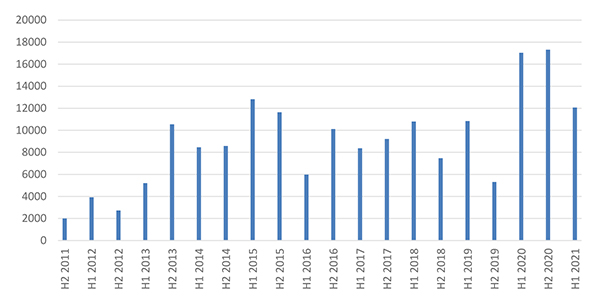

Capital raising remains above pre-pandemic levels

In 2020, the COVID-19 pandemic caused a resurgence in UK Capital Markets activity. We saw capital raised by listed companies reaching its highest level in more than a decade as investors responded strongly to the needs of public companies in the midst of the pandemic.

In 2021, while follow-on issues have declined from 2020 levels, capital raised in H1 remains well above pre-pandemic levels as corporates continue to rely on investors to support their businesses at this unprecedented time, whether that is to bolster their balance sheets or support opportunistic growth strategies.

H1 2021 saw a total of 357 companies raise new capital through follow-on issues, raising £12bn in capital. This is down from £17.3bn raised in H2 2020 and £17.0bn raised in H1 2020. However this figure remains well above pre-pandemic levels, averaging £9.0bn each half over the last 10 years.

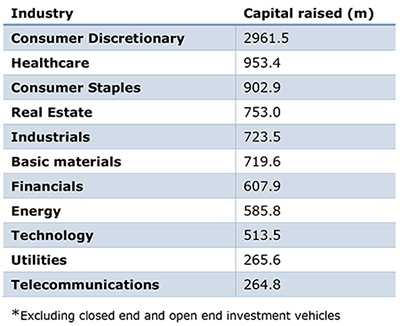

Consumer and healthcare industries lead capital raising

Excluding listed closed end and open end investment vehicles that invest across a range of sectors, businesses in the consumer discretionary industry raised the most capital, raising more than £2.9bn. This industry classification includes sectors such as automotive and household goods as well as the travel and leisure sector. This was followed by the healthcare industry, which raised £1.0bn, and consumer staples, which raised (£0.9bn) across sectors including food and beverage producers and retailers.

This data demonstrates that while capital raising remains strongest across the sectors most adversely impacted by the Covid crisis, including retail, travel and leisure, opportunities are also present for businesses looking to leverage shifting trends in consumer behaviour.

Travel and leisure businesses fight for survival

Ongoing Covid restrictions have meant that travel and leisure companies remain severely impacted by the pandemic, relying on investors to support their businesses through this period of radically reduced revenues.

13 companies in the travel and leisure sector raised capital in H1 2021, raising a total of £2.2bn, including TUI, which raised £597m and Jet2, which raised £422m. Meanwhile, several restaurants and bar operators were also forced to turn to investors to ensure their survival including SSP, raising £475m, and Mitchells & Butlers, which raised £351m.

Reduced footfall and shifting shopping habits have created turbulence in the retail sector, leading several businesses to seek investor support either to sure up balance sheets, invest in technology or fund acquisitions. In the fifth largest transaction of the year, JD Sport raised £464m to provide the flexibility to invest in strategic acquisitions.

Opportunities for strategic growth

Some of the largest transactions in the first half of the year have been from ambitious companies seeking to accelerate growth plans during a time when consumer and investor behaviours are shifting.

In the technology space, Draper Esprit raised £110 million to accelerate its strategy of investing in early-stage technology businesses across Europe. In one of the largest transactions of the year so far, Auction Technology Group raised £244m to help finance a $252m acquisition of LiveAuctioneers, a leading curated online North American Arts & Antiques Marketplace.

In healthcare, AIM-listed Hutchmed raised £387m in a Hong Kong listing, while in logistics, Tritax EuroBox, the specialist investor in European logistics, raised £198m in a heavily oversubscribed fund raise as it seeks to capitalise on near term opportunities in the burgeoning property sector.

The rise of ESG

As ESG becomes an increasingly important element of the capital raising landscape, we have seen corporates leveraging this trend to raise capital for projects to build more sustainable businesses.

AIB issued a €750 million Green Bond, its second in less than a year, where the proceeds will contribute to the financing of projects with clear environmental and climate change benefits.

Meanwhile, Severn Trent raised £250m to help fund six projects for the government’s Green Recovery programme.

This is a marketing communication.