About Southwest Airlines

Southwest Airlines is the largest low-cost carrier (LCC) in North America and the only US-listed airline to have an investment grade credit rating. Its low-cost operations, domestic US leisure focus, highly experienced management team, and strong balance sheet helped the company to weather the COVID-19 pandemic better than peers. The team believed it would be a key beneficiary as the US economy re-opens and consumer demand normalises on the successful rollout of a COVID-19 vaccine. This was a proprietary trading idea of the desk after extensive market/sector analysis. The team also consulted with our in-house aviation expertise as well as third party research to help to inform this view.

The Trades

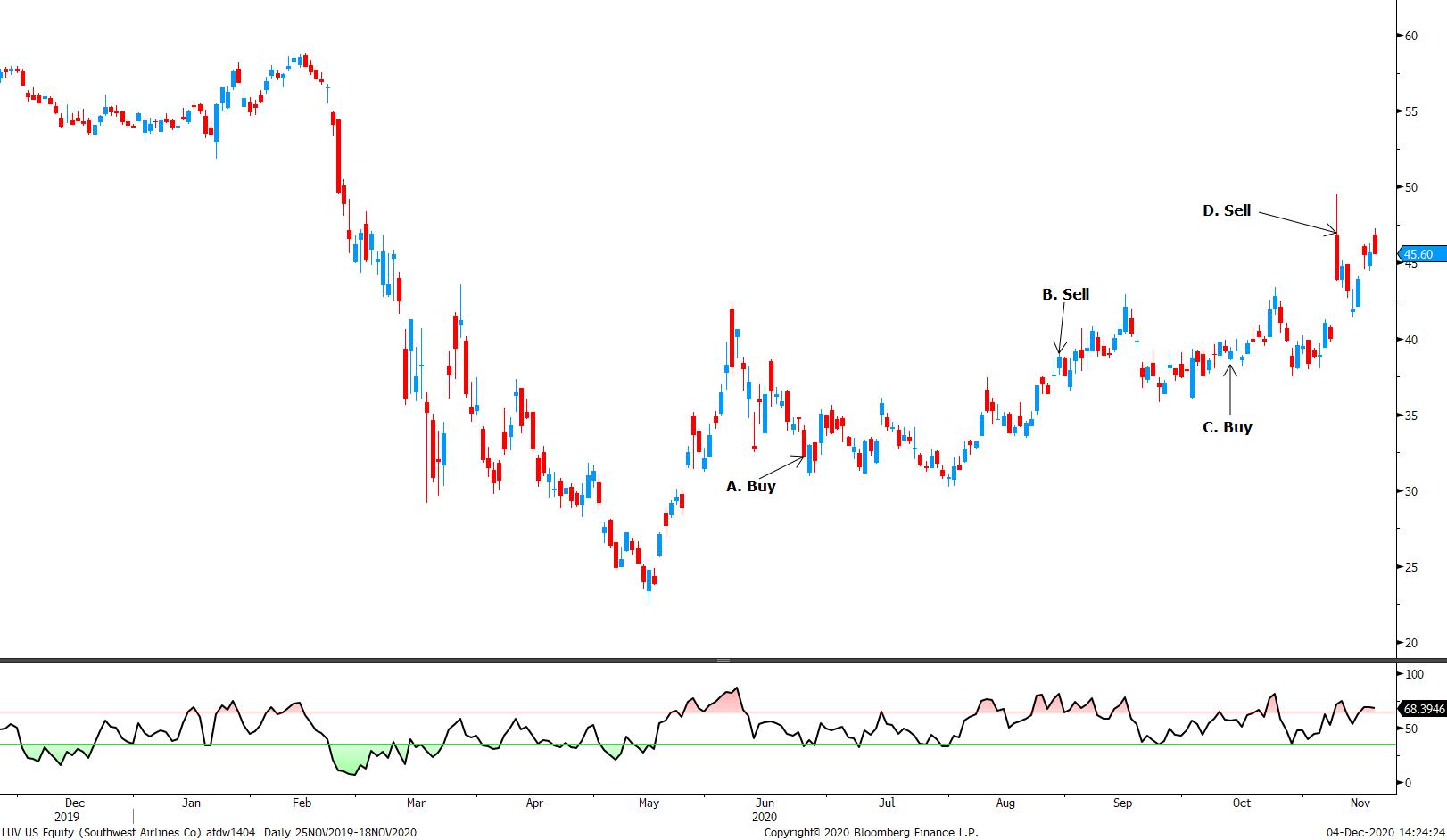

As you’ll see in the chart and the table below – the team bought and sold this idea two times as part of the Best 8 basket between June and December 2020, generating strong trading profits each time. This example highlights the benefit of partnering with a team that not only can generate strong trading ideas for clients but can also navigate short-term volatility, gauge entry and exit points, and stick to strict money management discipline – all necessary ingredients for a successful trade.

| Stock | Buy Date | Sell Date | Profit* |

| Southwest Airlines | 24 June 2020 | 27 August 2020 | 14.5% |

| Southwest Airlines | 13 October 2020 | 09 November 2020 | 18.9% |

Warning: Past performance should not be taken as an indication or guarantee of future performance.

Warning: Past performance is not a reliable guide to future performance.

Warning: The value of your investment may go down as well as up.

Warning: If you invest in this product you may lose some or all of the money you invest.