What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

- Last week was another volatile week although ending on a slightly better note. The fixed income markets were the focus again as they continued to grapple with the ‘higher for longer’ narrative. This culminated with a very strong jobs report from the US (the non-Farm Payrolls) on Friday leaving bond investors worried not only about how long interest rates will remain high but also, we may not have seen the peak yet. Equity markets focused on the earnings component; average earnings declined to 4.2% year-on-year. The jobs market might be strong, but it is not inflationary.

- Within bond markets, the main weakness has once again been in longer dated bonds. If you look at 2-year sovereign yields in both the US and euro area, they are down (price up) during the week. Yield curves are flattening, which makes us more comfortable with the fixed income markets. In fact, there has been such a move up in long dated yields that lengthening duration is now worth considering. In equity markets, yield sensitive sectors were the weakest sectors last week (Utilities, Property) but these have also fallen so much that they may start outperforming from here. For the overall market the third quarter earnings season is now upon us, and this should give some support.

- Despite the volatility, there were a couple of positives last week. Firstly, the rising bond yields is tightening financial conditions, reducing the pressure on central banks to hike rates. Secondly, there was a correction in the oil price, down 10% from recent highs. If this carried on it would be a boost to bonds and equities, but the conflict in Israel (see below) could hamper this.

- Unrest in Israel will make investors nervous and there is a modest move to ‘safe haven assets’ (bonds; gold; US Dollar). The main impact to markets is the oil price. It is well below the recent high, but it has spiked and does need to be monitored.

Macro views

- Chinese Manufacturing and non-Manufacturing sentiment rose in September, and both are back above the 50-level indicating expansion. The Manufacturing PMI hit the highest level in six months, while the non-Manufacturing rose for the first time in six months. The data is indicating that economic momentum is going sideways now after several months of decline. The supportive measures being introduced by the Chinese government should add to this improvement.

- The United States ISM (Institute of Supply Management) improved further last week, rising from 47.6 to 49.0, the highest reading in almost a year and indicating that the manufacturing sector is close to stabilising. On the other hand, the ISM non-Manufacturing Survey dropped in the month but still stands at a healthy 53.6, well into expansion territory. The upward momentum in the US economy is not across the board, the manufacturing sector is well into recovery mode, but the services sector is now beginning to slow.

- Retail Sales data for August was released in the euro area last week. It was +1.2% month-on-month (-2.1% year-on-year) which was significantly weaker than expected. The number is following the trend set by the Consumer Confidence indicator but seems strangely weak given the record low level of unemployment and salary settlements that are now running close to the rate of inflation. It is likely to be revised upwards but indicates that the region’s economy is close to stalling.

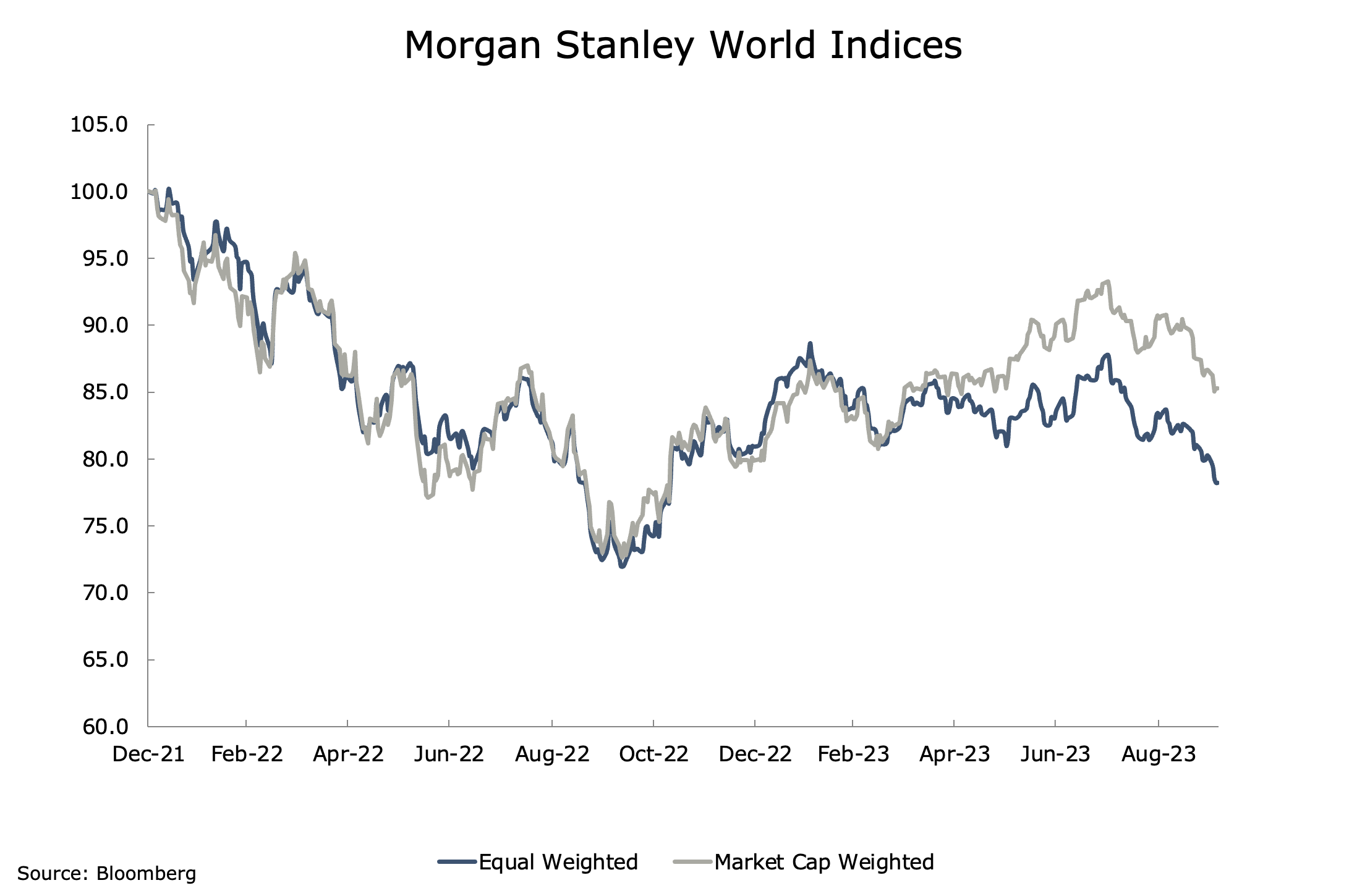

Chart of the week: More realistic

At headline level, 2023 looks like a reasonable year for equity markets. In Euro terms the Morgan Stanley All World Index is up almost 9%. However, this performance is very concentrated. If we look at the equal weighted index (all companies in the index have an equal weight) which is the blue line in the chart above, the message is somewhat different. Year-to-date this index is down 1.5% and getting back towards the lows of 2022 when fears of a global recession were at their height. The outlook for equity markets is not bright, but now the average share price is beginning to reflect that.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |