What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

- The holiday-shortened trading week led to subdued market moves. World equities were up just about 0.5% in euro terms. Bond markets were under a little bit of pressure as the minutes of the European Central Bank’s (ECB) latest meeting were released. The minutes were more hawkish than expected, discussed the possibility of another rate rise and reiterated the higher-for-longer mantra. Euro area bond markets have enjoyed a good run this month, returning just under 2%, as expectations for interest rate cuts next year increase. However, the ECB minutes remind us that interest rate cuts are not a foregone conclusion.

- Oil prices were in focus last week. On Monday, oil prices rose by 5% as expectations of output cuts from OPEC+ gathered steam. As it turned out, the meeting which was meant to discuss the cut was called off, and the oil price lost half of its gains by the end of the week. It is some time since we have seen dissent within OPEC+ about production changes, so output cuts may not be as easy to achieve. That is good for energy consumers in the developed world – and it certainly helped equity markets in the second half of the week.

- We welcome a bit of cooling in bond markets. We were increasing our exposure to longer dated bonds but, with the big moves down in yields that occurred in November, we put that process on hold. Within equity markets, we are looking to increase our exposure to the bond yield-sensitive sectors (such as Utilities and IT). However, these sectors have performed strongly in November, and we feel we will get a better entry point.

Macro views

- On a positive note, the euro area Purchasing Manager Index (PMIs) surveys, which were released last week, came in better than expected. The composite index came in at 47.1, beating the 46.8 forecast and up from last month’s reading of 46.5. It is still in contractionary territory but is less bad. Both the Manufacturing and Services indices improved. It is only one month’s data, but it could indicate a stabilisation in the euro area economy. Meanwhile, the bloc’s Consumer Confidence survey was better than expected and up month-on-month. This is a welcome change as a very cautious euro area consumer has been a big weakness in the region’s economy.

- The minutes of the Federal Reserve’s interest rate setting committee (FOMC) revealed unanimous support for its decision to hold interest rates steady. Members spent a good deal of time discussing the tightening in financial conditions that occurred in October as bond yields rose as a reason to pause and await further data. On the outlook for interest rates, the minutes merely said that monetary policy should be kept restrictive to return inflation towards 2%. There was no mention of any further interest rises which is a change from the previous month where “one more increase” was left as an option – that’s more evidence that we have arrived at the peak in US interest rates.

- There was some good news from China last week: it looks like the authorities are close to finalising the list of property developers that will get ‘financial support’. This will be a help as it should start improving confidence in the housing market. At the moment, buyers are staying away as housing developments may not be completed due to the financial difficulties of the developer. We have a long way to go but it would be a helpful first step.

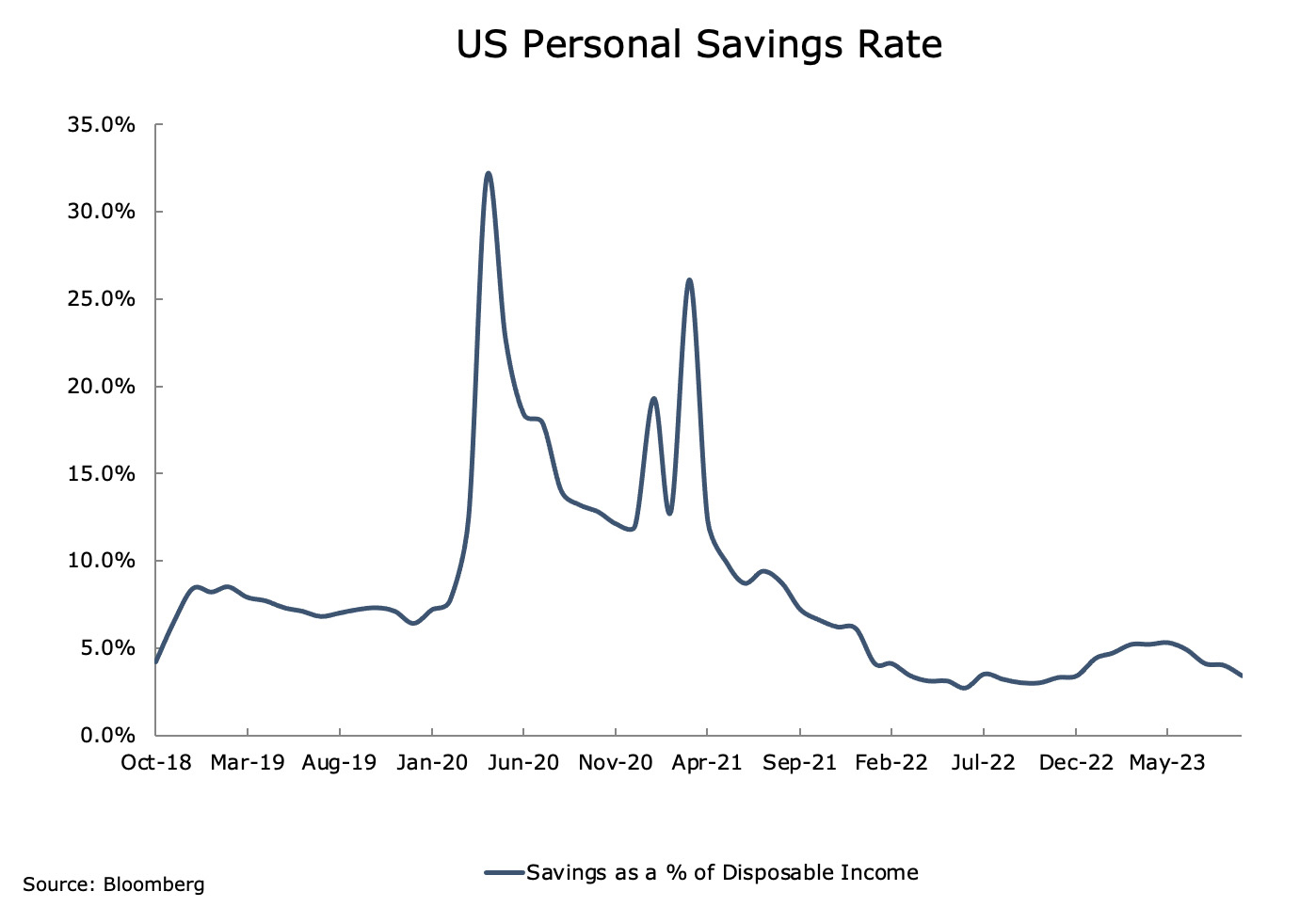

Chart of the week: A headwind for consumption in the US?

The US economy has performed much better in 2023 than people expected. Personal consumption proved to be more robust than forecast. Part of this is down to US consumers drawing down on their savings. As you can see in the chart, over the last five months the savings has been declining and it is now close to post-pandemic lows. It is difficult to see savings being drawn down by the same amount next year. Income growth is levelling off so the drivers for consumption do look weaker in 2024 – and this is one of the reasons why we expect a subsidence in US growth next year.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |