What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

- October’s woes were left behind very quickly as financial markets staged strong rallies in the first week of November. World equities delivered nearly 4% in euro terms and the euro area fixed income market returned 1.4%. The meeting of the Federal Reserve’s interest rate setting committee (FOMC) was the major driver of these moves. For the second month in a row, it left interest rates unchanged, increasing confidence that we may have reached the peak in interest rates in the US. Bond markets also got a boost from an announcement from the US Treasury that it will be selling less long-term bonds than originally expected.

- In fixed income markets, longer dated issues led the market as the market priced in a peaking in interest rates. In the euro area, sovereigns did better as economic data coming from the region remained soft. In equity markets, interest rate-sensitive sectors were strong (Utilities; Property; and IT) and some of the sectors that were the most beaten up in October also enjoyed a good performance (Consumer Discretionary and Industrials).

- Last week was mainly about markets pricing in a peak in interest rates in the developed world. This is not an unreasonable thing to do. We have felt for some time that central banks were looking for reasons to pause. Going forward from here, fixed income markets are in a better place. Interest rate increases are, perhaps, off the agenda for a while, and there is a realisation that they may not be coming down anytime soon. Equity markets face the challenge of the continuing squeeze on economies and thus profits and the chance that the Israeli conflict could flare up.

Macro views

- Economic data from the US indicated some cooling in activity. The main one was the employment report. 150,000 jobs were added during the month – that was below the forecast level of 180,000. In addition, there were downward revisions to the previous months’ figures. The main business sentiment surveys (the ISMs) were also released. Both Manufacturing and non-Manufacturing dropped during the month. The Manufacturing Survey was particularly weak – it dropped well into contraction territory and close to the lows for this year. These data points should help keep the Fed on hold.

- We got as many the number of updates from the euro area. On the bright side, the inflation figure was pleasing. Headline inflation dropped below 3% year-on-year and the core rate fell 0.3% to 4.2, its lowest reading since July 2022. Conversely, the release of third quarter GDP figures showed the region’s economy contracted leaving it almost flat year-to-date. A weak business survey (manufacturing PMI) added to the gloom over the growth outlook in the region. This combination of little growth and steps down in inflation increases the probability that the European Central Bank will remain on hold.

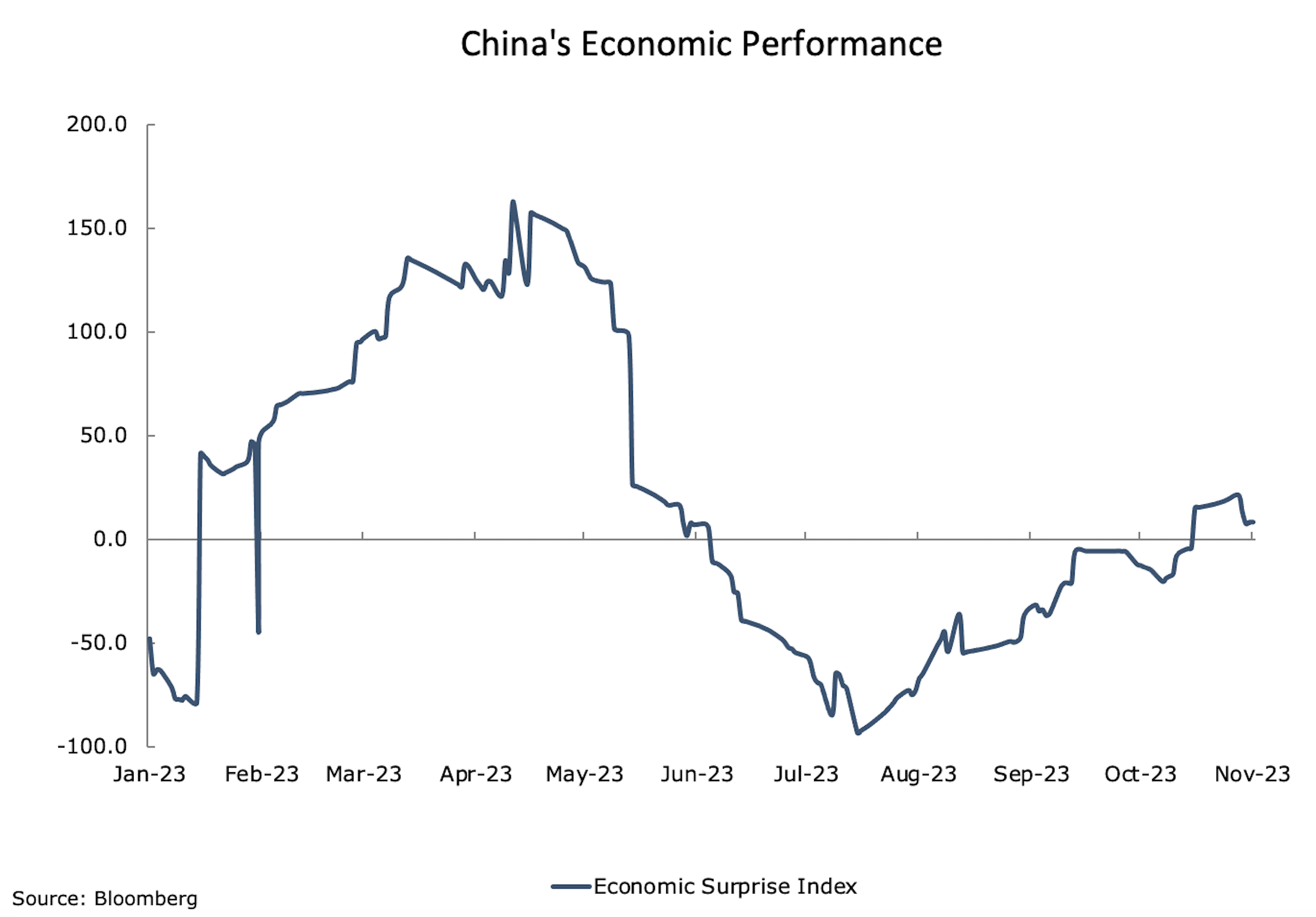

- Chinese data was a little bit disappointing last week. Business sentiment surveys (the PMIs) were released and were down month-on-month against expectations of an increase. It is disappointing that the Manufacturing survey after steadily increasing every month since April fell and went back into contraction territory below 50. However, it is only one data point and the broader news flow from China has been more upbeat (see our chart of the week).

Chart of the week: Is it turning?

Last week, the data releases from China disappointed investors and left them questioning the outlook for the Chinese economy. However, one should keep these in context. The chart above shows how the broad range of economic data from China compares against forecast. Once the line goes above zero, the Chinese economy is performing better than forecast. As you can see, we have moved above zero and significantly better than the middle of the year. To us, it looks like the momentum is at least stabilising and that the country will not be a drag on global growth going forward.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |