What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

The tragedy unfolding in Ukraine over the past week has been extremely difficult to watch and comprehend. The horrific scenes are having an enormous impact on us all.

We will continue to monitor market developments closely as the crisis deepens and provide clear investment updates to you.

Market views

- The escalating conflict in Ukraine is dominating market moves – and a greater portion of the moves last week represented a “flight to safety”. For the first time since the war began sovereign bonds were bought and 10-year yields dropped close to 30bps in the euro area and the US.

- There has been a ratcheting up in the conflict in the last few days with energy sanctions now back on the agenda. Implementing them hurts both sides which is the main reason they have been avoided up to now. It would be a big change in approach from Europe and the US if they were enacted but it cannot be ruled out.

- Changes to economic forecasts that we have seen so far have brought growth rates down but still leave us at or above trend in the major regions and well away from recessionary conditions.

- In equity markets, the Energy and Mining sectors led during the week. These price moves reflect what investors think might happen going forward rather than what is currently happening with supply and demand and hence may not be sustainable through the year. Cessation of hostilities will turn all of this on its head.

- Another equity market development to highlight is the shift towards defensive and quality growth. After Commodities, the other sectors that have been in favour since the conflict began are Consumer Staples and Utilities. These sectors had to contend with rising bond yields prior to this and still do, but the attraction of their more secure earnings streams may overcome this in the future. We believe that will happen.

Macro views

- All eyes were on Federal Reserve Chair Jerome Powell’s testimony to the US Congress last week to see if there was any change in mood following Russia’s invasion of Ukraine. He said that the Fed would continue on its path to normality but carefully. There was relief that he seemed to rule out a 50bp hike this month re-enforcing the view that policy change will be gradual.

- Central banks are in something of a bind: economic data has shown very healthy growth and very healthy labour markets. Last week in the US, there was an unexpected increase in the ISM Manufacturing Index and the jobs report showed an increase in employment of almost 700,000 in February. In the euro area, unemployment dropped to a new low in January.

- There has also been little abatement in inflationary pressures. In the euro area, core inflation picked up to 2.7% year-on-year. In the US, the Manufacturing survey showed no decline in the prices paid. They will be mindful of the potential fall-out from the invasion of Ukraine, but for the moment, it is hard to argue for material change. The European Central Bank meets this week, and we may get further clarity then.

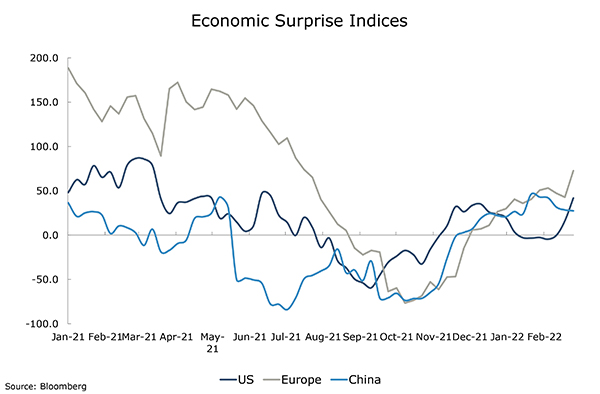

Chart of the week: how is the world economy performing?

This chart indicates how economic data released compares against forecasts across the three major regions. As you can see, it has had a notable increase this year with the economies performing well above trend since the turn of the year. This economic performance is a major driver of our overweight position in equities. Economic performance has been very strong going into this crisis and was accelerating. Thus, we would expect it to be relatively resilient in the face of it.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |