An analysis of follow-on issues on the London Stock Exchange Main Market and Alternative Investment Market to identify the trends shaping capital raising activity from London-listed businesses.

Capital raising drops to decade-low as economic headwinds start to bite

Capital raising from UK-listed corporates fell very significantly in the first half of 2022 as concerns over growth and inflation were compounded by war in Ukraine and economic uncertainty.

After the record pace of fundraising during the pandemic, the sharp move in valuations across nearly all sectors has dissuaded UK PLCs from raising new capital, instead choosing to hone strategy, start buyback programmes if appropriate, and focus on what they can control.

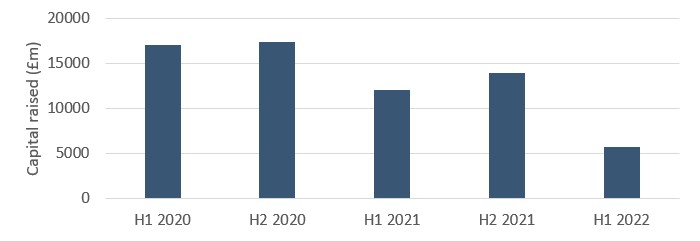

Our analysis shows that in H1 2022, just £5.7bn in new capital was raised by UK PLCs, the slowest start to a year in nearly a decade. When excluding listed investment vehicles, this figure falls to £2.5bn.

The analysis demonstrates a marked shift from the last two years, where corporates adversely impacted by the pandemic turned to investors to shore up their balance sheets. Capital raising in the first six months of 2022 is less than 50% of that in the first half of 2021, and around a third of the amount raised in the first half of 2020.

Weakening market confidence has meant the number of large transactions has declined very significantly in comparison to figures from 2021. In the first half of the year, no companies raised more than £1 billion in a single transaction, while Ocado Group was the only corporate to raise more than £500 million, as it looks to expand its technology arm in the second half of this year.

Consumer industries most active out of necessity

Those businesses that are choosing to raise capital have done so mostly on a needs must basis, with particular and time sensitive requirements.

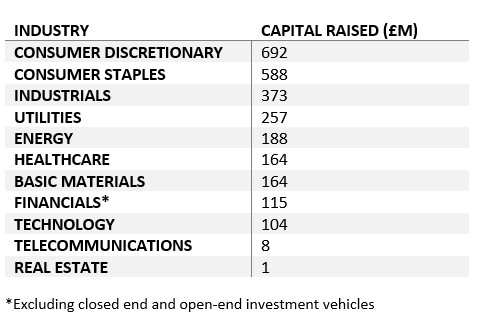

The most active sectors for capital market activity continue to be consumer industries impacted by the pandemic and currently facing reduced consumer confidence. Consumer Discretionary businesses raised the most capital (£692m), followed by Consumer Staples (£588m) and Industrials (£373m).

Forward view

While it is impossible to say with certainty when activity will begin to pick up, our view is that this will happen once there is more clarity on the interest rate cycle in Europe and the US and, importantly, some visibility on inflationary pressures subsiding. The latter could reasonably come through in late Q3/Q4 this year, not least as we start to lap into higher comparatives from this time last year. For now, corporates are focusing on what they can control, and considering buyback programmes if appropriate while valuations are depressed.

Having expected another active IPO year as we started 2022, it is now much more likely that companies looking to list will plan on 2023 timetables. For those that are doing so, there is plenty of opportunity throughout the rest of this year to undertake the preparation work and relationship building with investors that is needed.

This is a marketing communication.