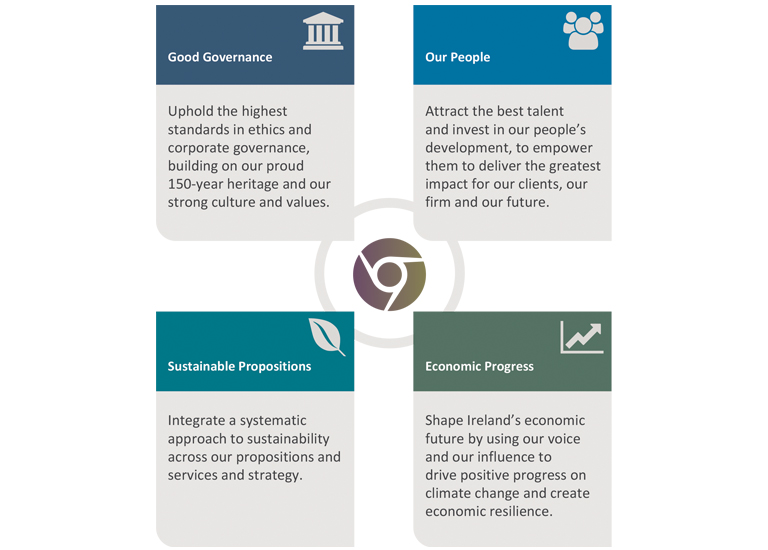

Because the Goodbody origins stem from principles of stewardship, integrity, and community by life-long entrepreneurs, it is in our DNA to create long-term prosperity. And we believe that long-term economic prosperity is increasingly interlinked with environmental and social risks and opportunities. That is why sustainability is a core pillar of our strategy and is implicit in our values. But our ambition is greater - we have set our sights on being a sustainability leader. We see sustainability as a driver of innovation and a source of competitive advantage and future revenue growth. Throughout our 150-year history, we have witnessed many changes, but the decades ahead will be unprecedented, as the climate crisis and other global sustainability challenges transform how we live and work. The links between people, planet and economic prosperity have never been clearer. We believe that the changes we are facing present major financial risks but also significant investment opportunities. As trusted financial advisers, we have a responsibility to proactively manage the risks and opportunities and to enable our clients to future proof their investments and commercial strategies. We need to provide advice today that is fit for tomorrow. In the last 12 months, we have made progress on our sustainability journey, identifying areas that we can have an impact as a business and gaps that we need to address to meet our ambition.

Martin Tormey

CEO, Goodbody

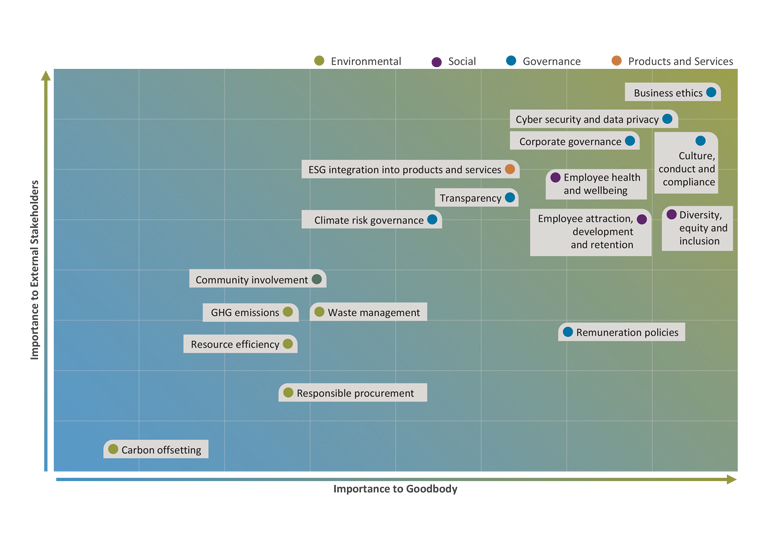

To advance our approach to sustainability, Goodbody undertook its first materiality assessment in 2022. We engaged an external partner, SustainabilityWorks, to conduct this independent analysis and help us advance our ESG strategy. The methodology applied followed the Global Reporting Initiative (GRI) principles and included a review of industry best practices and emerging trends; peer assessment; and stakeholder input (including clients; prospects; staff; and vendors).

By ranking the relative importance of ESG issues via proactive engagement with stakeholders, it ensures the top priority issues are explicitly captured within the strategy that we have developed for our firm. Over the next 12 months, a dedicated Sustainability Taskforce within the firm will have responsibility for actioning and progressing key actions and we will publish progress and milestones periodically.

Linked to our purpose, we believe that we can contribute to long-term prosperity of our clients if we anticipate and respond to the risks and opportunities linked to the defining challenges of our time – including climate crisis. At Goodbody, we are doing this by leveraging our propositions, our influence and our sustainability expertise to future proof our clients’ investments and commercial strategies.

In 2020, Asset Management became a signatory to the UN PRI and our approach to ESG is guided by the six principles

Goodbody is a member of Sustainable Trading Initiative

Award-winning community partnership programme

You might be interested in