What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

December was a tough month for financial markets: world equities were down 7.1% in Euro terms and the euro area fixed income markets delivered -3.6%. Central Banks featured again with the ECB taking centre stage at its December policy meeting. It surprised the market with the statement "interest rates will still have to rise significantly at a steady pace”, leading to higher interest rate expectations in the region and pulling the bond market down. This did not help equity markets, but they were also undermined by robust economic data from the US reducing the near-term chances of a ‘pivot’ from the Federal Reserve.

Since the last Market Pulse we increased our exposure to fixed income markets, bringing our fixed income allocation to a neutral level for the first time in many years. Yields had risen to levels that the income return from fixed income looks attractive relative to a deposit rate. Inflation is showing signs of falling and this could accelerate over the next few months which should mean the risk to fixed income markets will be lower. Central Banks may not react quickly to declining inflation statistics, so the increase in fixed income exposure was short dated.

To fund this higher exposure, we moved to an underweight position in equities. With global economic growth slipping towards 2% in 2023 and pricing power weakening, it will be a very challenging year to deliver earnings growth. We have already seen some meaningful cuts to profit forecasts for 2023 and earnings are now expected to grow by 2.7%. The upcoming reporting season could give some relief, but it is likely to be short lived.

Macro views

The data flow was dominated by the US last week. The ISM surveys (both manufacturing and non-manufacturing) were released and both of them dipped below 50, indicating contraction. The non-farm payrolls on the other hand still showed strong jobs growth, with more than 200,000 jobs created in the month. The forward looking surveys say recession is likely but the actual says if it comes it will probably be shallow.

The minutes of the last meeting of the FOMC (the interest rate setting body of the Federal Reserve) were released last week. The most interesting point was the caution about "unwarranted easing in financial conditions". This has happened as market forecasts for US interest rates for 2024 have declined despite the rhetoric from the Federal Reserve. The markets expect US interest rates to be cut by 2% in 2024. The Federal Reserve seems to be saying that financial markets are getting ahead of themselves.

China is caught up in the turmoil of a rapid lifting of Covid restrictions. The PMI surveys for December dropped sharply. The Non-Manufacturing PMI dropped to 41.6, well into recessionary territory. The big spike in infections after the lifting of the restrictions is having its impact on consumption. The Manufacturing PMI was more resilient, dropping only 1 point to 47 so supply chain impacts should be muted. The equity market has moved to anticipate a recovery from these levels. With the major holiday season coming this month, it may not be a straight-line recovery.

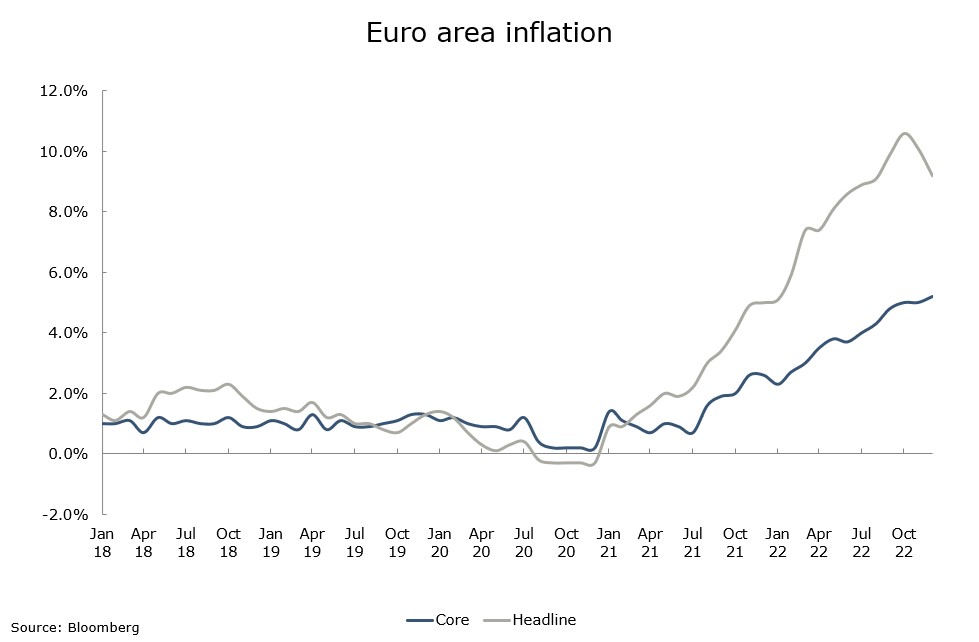

Chart of the week: Good news for Consumers but not for the ECB

The inflation report for the euro area was released last week and it was a mixed outcome. Headline inflation fell more than people expected as energy prices declined significantly: the natural gas price is now back to where it was in November 2021. This is good news for the euro area consumer and thus for growth in the region. However, the core price index rose again against expectations for a slight drop. This will keep the ECB on an aggressive tack which markets will not like. However, we did see the same pattern in the US. Core inflation levelled off, then spiked up before starting to fall again.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |