What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

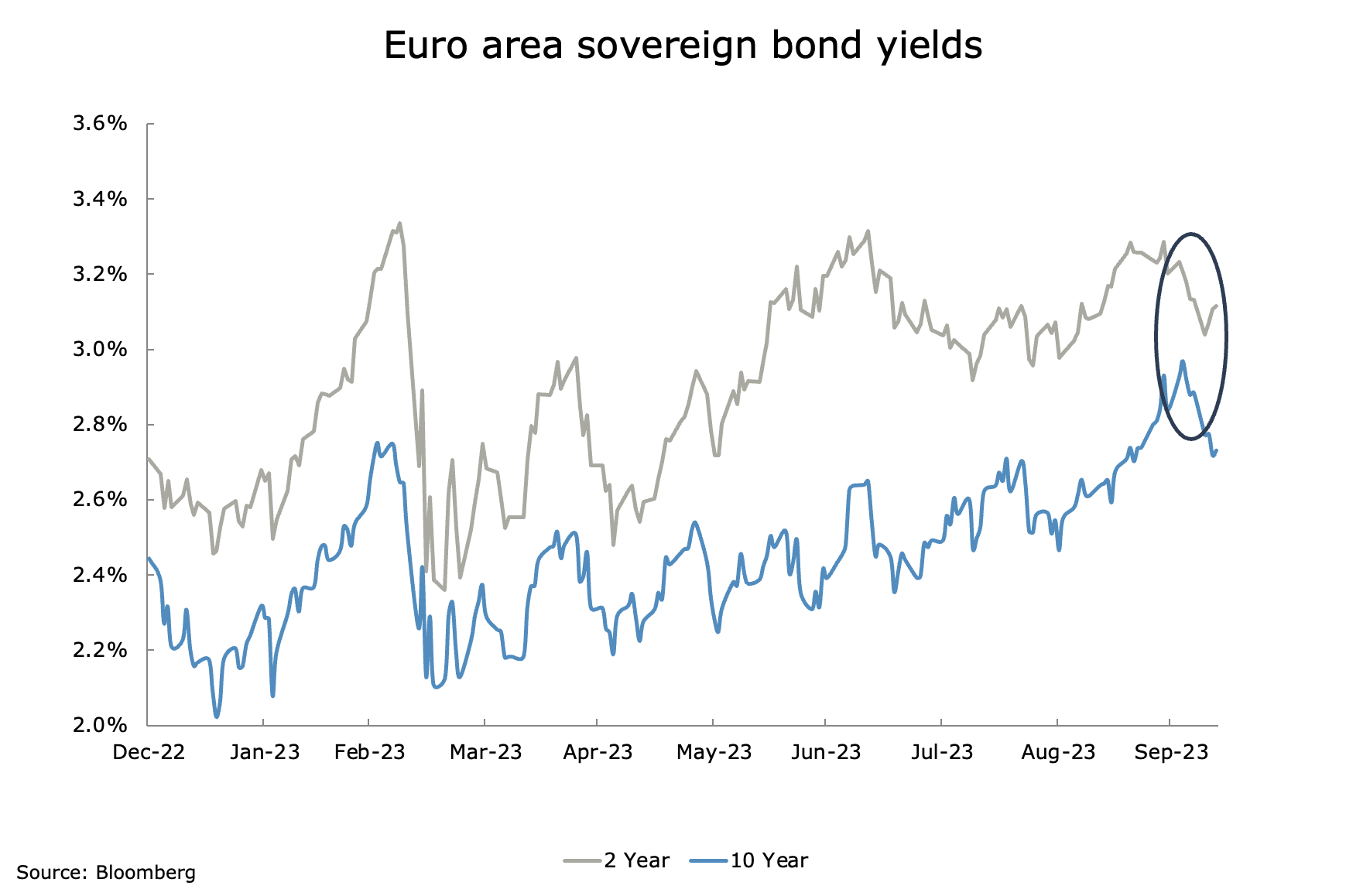

- Bond markets led a recovery in financial markets last week (the euro area bond market returned about 1%), as 10-year yields dropped nearly 20bps. It was central bankers that came to the rescue. Several members of the FOMC, (the interest rate setting committee of the Federal Reserve) including the chair, commented that the recent rise in bond yields was tightening financial conditions to such an extent that the Fed did not need to do any more. European Central Bank council members also joined in. Three of the more ‘hawkish’ committee members: J. Nagel (Germany), K. Knot (Netherlands) and M. Kazaks (Latvia), all made statements indicating that they thought policy was correctly set to get inflation back on target. Pausing hiking rates by central banks across the developed world seems more likely now.

- Of course, falling bond yields ease financial conditions, so there is only so far that they can decline on this idea. What is more interesting is that it may indicate at what yield level the Federal Reserve will begin to get worried about the bond market. This suggests that where yields got to last week is a good point to start buying longer dated bonds. The volatility has not gone away, so there will be other opportunities to execute that trade.

- Equity markets took their lead from the bond market with lower bonds giving a valuation boost. Unsurprisingly, it was the bond yield sensitive sector (Utilities and Property) and Energy that led the markets up last week. The third quarter result season is now starting. There have been few changes to forecasts in recent weeks, so it is likely to be reasonably good and give equity markets a boost in the short term. The conflict in Israel will keep risk appetite down, but we do not know for how long.

Macro views

- Inflation data from the US was the key release last week. It did temper the good mood in markets as it came in slightly higher than expected. The core rate did drop, now down to 4.1% year-on-year, but the monthly increase was slightly higher (0.32%) than recent months. The surprise in this figure was the rise in shelter costs which were expected to continue decelerating. The inflation outlook to the end of the year in the US is expected to become more difficult. Health costs are expected to rise again and a higher oil price will impact on many things including airfares. As a result, the upward surprise did not lead to big price moves in asset markets.

- In China, rumours emerged of a large stimulus package being announced were spreading. This may or may not come to pass but a clearer message came from the state sovereign fund as it built up its equity holdings in the four main banks and signalled it could increase them further. The authorities are showing their intent to stabilise the local economy and markets.

- In the euro area, Industrial Production data was released. It was a bit better than expected but much of this was driven by a large move in Ireland. On a year-on-year basis it is still very weak, down over 5%. The best one can say is that the industrial sector is stabilising but there is little evidence of a recovery. A better Chinese economy and a weaker Euro should help, but the euro area economy still appears moribund.

Chart of the week: Go long

During all of 2023, we have been saying to keep fixed income exposure in short-dated bonds. Last week was the first time that we sold short-dated bonds and bought longer dated ones. The trigger was 10-year yields reaching almost 3% (blue line above) while shorter dated yields fell. The yield curve had almost flattened (short-dated yields were the same as long dated yields), which was an indicator we were waiting for to start lengthening the maturity of our fixed income holdings. The 10-year yield dropped rapidly during the week after reaching this level indicating there is good support for the market at this yield level and hence it is a good entry point into the longer dated part of the market.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |