What’s going on in financial markets? Which macro themes should you watch? Drawing on our depth and breadth of market and economic expertise, Market Pulse brings you insights on the latest investment themes to help preserve and grow your wealth.

Market views

- It was a negative week for global markets as stronger than anticipated US economic data underpinned the high for longer interest rate outlook. Dovish central banker commentary was offset by geopolitical concerns. European bonds declined by ~0.7% as government bond yield curves steepened (long-term yields moved up more than short-term yields). German 10-year bund yields rose about 0.2% while US 10-year bond yields rose about 0.3%. Global equities followed the bond moves and geopolitics, declining ~2%. Oil prices have moved higher on supply risks, supporting Energy as the best performing sector while Real Estate was the worst.

- It’s early in Q3 earnings season with only about 20% of the S&P 500 companies having reported, and some of the early reporters are in idiosyncratic sectors. Europe has reported less and provides less quarterly detail. So far, S&P 500 Q3 EPS has come in about 7% ahead of expectations, with ~4% EPS growth year-over-year; trailing 12-month EPS growth is still negative but improving. The surprise factor in Q3 seems well distributed across sectors with only Energy disappointing. The consumer sectors are leading the growth, with IT showing the weakest. Share price reactions are quite asymmetric, with outperformance modestly rewarded and earnings misses being heavily punished.

- US Q3 GDP first estimates are due this week, but US Personal Consumption Expenditure (PCE) inflation data due Friday will likely be the most watched data as it is the Fed’s preferred inflation metric.

Macro views

- US economic data was stronger than anticipated last week, which drove bond yields up (prices down) and share prices down. The US consumer showed continued strength with retail sales up 0.7% month-over month (m/m) compared to expectations for 0.3%; retail sales ex-autos were up 0.6% m/m, with upward revisions to prior months. Industrial production also surprised, up 0.3% m/m vs expectations for -0.1%. There was some softness in industrial surveys but with positive forward-looking indicators. Initial jobless claims fell below 200,000 for the first time since January.

- China’s Q3 GDP data showed growth of 4.9% year-over-year (y/y), 0.5% higher than anticipated, with stable industrial output (+4.5% y/y) and retail sales up 5.5% y/y, 0.8% ahead of forecasts. The property market appears to be lagging the rest of the Chinese economy, although the linkages of it to the global economy are relatively low.

- US Federal Reserve Chairman Jerome Powell was amongst the key policy makers speaking this past week. Other Fed Governors’ comments earlier in the week seemed to support a pause in rate hikes, but these came before the strong economic data. Chair Powell noted progress to date to reduce inflation, the pending impact of significant tightening to date including higher bond yields, and the resilience of economic growth. He also noted that additional evidence of economic strength might be necessary to warrant further rate increases. Hence, while the Fed remains attentive to inflation risks, the indication of ‘proceeding carefully’ was generally taken to mean a pause in November with future rate hikes data dependent.

Chart of the week

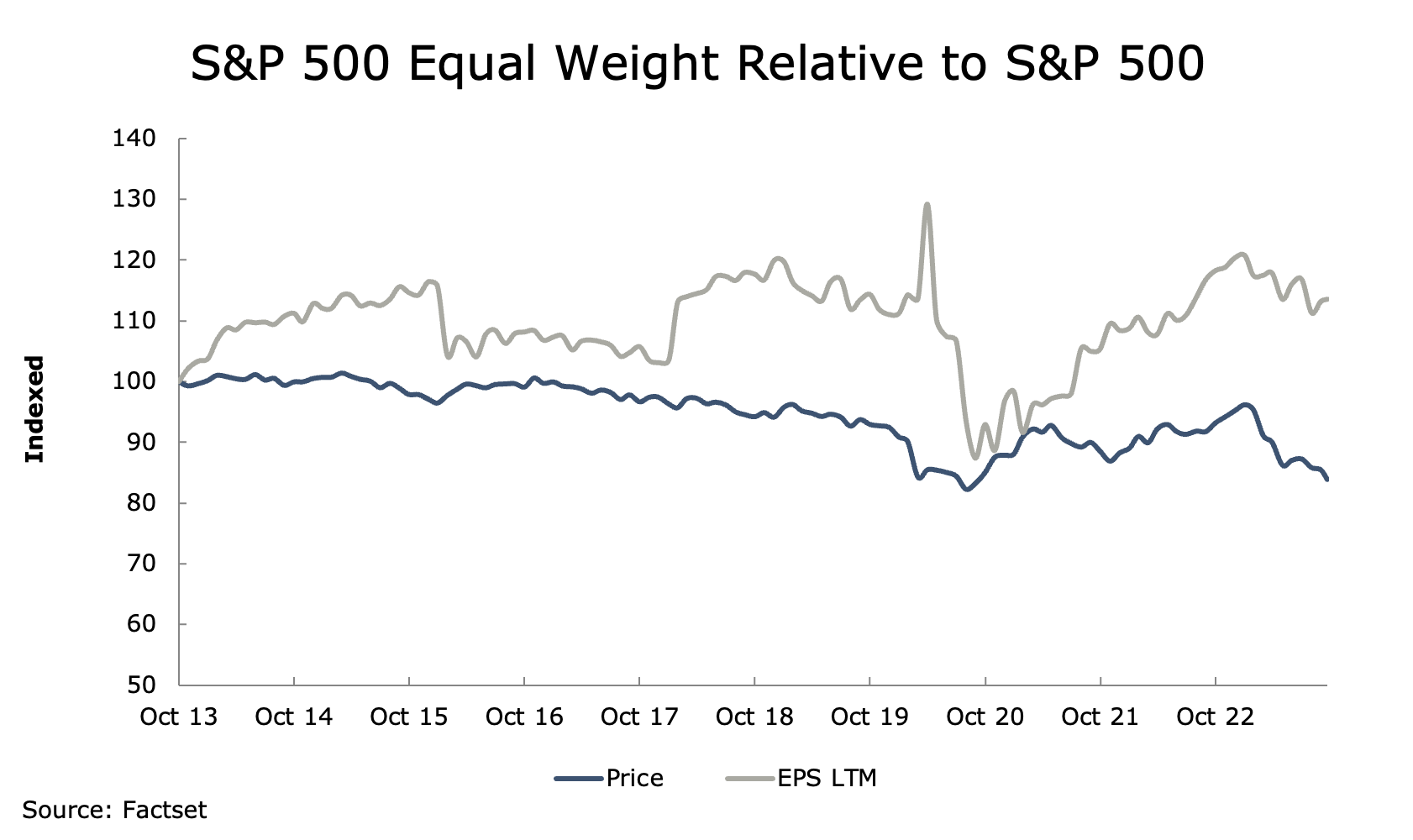

This week we delve a little deeper into the relative performance of the market cap weighted S&P 500 Index (the most widely followed), and the S&P 500 Equal Weighted Index, which represents the average performance of the constituents. Much has been made of the impact of the mega-cap stocks on the recent performance of the main index. The S&P 500 is up 12.9% year-to-date (ytd), while the Equal Weighted index is flat. The chart below illustrates that the equal weighted index’s price is at lows relative to the main index, comparable to where it was at the onset of the Covid pandemic, while earnings per share have held up better. Hence, on an historic basis, the average stock’s valuation is at 0.8x that of the main index, which is in line with recent historic lows. The average absolute valuation is also at post-GFC lows and the 2024 PE multiple of 14.0x compares to 17.6x for the main index. There are valid reasons why the larger, more liquid stocks trade at higher valuations, inter alia stronger balance sheets, less economically sensitive earnings (when EPS falls, the average stock tends to fall more). While the above isn’t going to predict near term market moves, it may tell us that the average stock is already discounting a less positive macro-economic outlook than the headline index.

What would you like to do next?

Talk to us | Read more insights | Read our investment approach |